| Zacks Company Profile for Peloton Interactive, Inc. (PTON : NSDQ) |

|

|

| |

| • Company Description |

| Peloton Interactive creates fitness products. The brand's content is accessible through the Peloton Bike, the Peloton Tread, and Peloton Digital, which provides a full slate of fitness offerings, anytime, anywhere, through IOS and Android as well as most tablets and computers.

Number of Employees: 2,145 |

|

|

| |

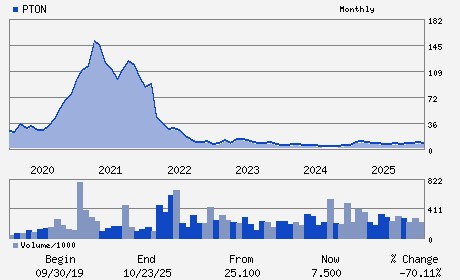

| • Price / Volume Information |

| Yesterday's Closing Price: $4.02 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 17,056,914 shares |

| Shares Outstanding: 425.49 (millions) |

| Market Capitalization: $1,710.47 (millions) |

| Beta: 2.47 |

| 52 Week High: $9.20 |

| 52 Week Low: $3.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-28.09% |

-27.46% |

| 12 Week |

-37.38% |

-37.46% |

| Year To Date |

-34.74% |

-35.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter Stern - Chief Executive Officer; President and Director

Elizabeth F Coddington - Chief Financial Officer

Jay Hoag - Director

Karen Boone - Director

Chris Bruzzo - Director

|

|

Peer Information

Peloton Interactive, Inc. (BAJAY)

Peloton Interactive, Inc. (ESCA)

Peloton Interactive, Inc. (GOYL)

Peloton Interactive, Inc. (FTSP)

Peloton Interactive, Inc. (KTO)

Peloton Interactive, Inc. (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: 70614W100

SIC: 3949

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 425.49

Most Recent Split Date: (:1)

Beta: 2.47

Market Capitalization: $1,710.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.05 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.11 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 45.29% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |