| Zacks Company Profile for Rubrik, Inc. (RBRK : NYSE) |

|

|

| |

| • Company Description |

| Rubrik Inc. help organizations achieve business resilience against cyberattacks, malicious insiders and operational disruptions. The company powered by machine learning, secures data across enterprise, cloud and SaaS applications. Rubrik Inc. is based in PALO ALTO, Calif.

Number of Employees: 3,200 |

|

|

| |

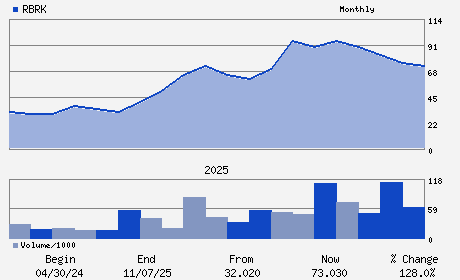

| • Price / Volume Information |

| Yesterday's Closing Price: $51.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,767,973 shares |

| Shares Outstanding: 200.14 (millions) |

| Market Capitalization: $10,399.36 (millions) |

| Beta: 0.46 |

| 52 Week High: $103.00 |

| 52 Week Low: $46.36 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.13% |

-6.32% |

| 12 Week |

-39.77% |

-39.85% |

| Year To Date |

-32.06% |

-32.39% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Bipul Sinha - Chief Executive Officer and Director

Kiran Choudary - Chief Financial Officer

Asheem Chandna - Director

R. Scott Herren - Director

Mark D. McLaughlin - Director

|

|

Peer Information

Rubrik, Inc. (ADP)

Rubrik, Inc. (CWLD)

Rubrik, Inc. (CYBA.)

Rubrik, Inc. (ZVLO)

Rubrik, Inc. (AZPN)

Rubrik, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 781154109

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 200.14

Most Recent Split Date: (:1)

Beta: 0.46

Market Capitalization: $10,399.36 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.47 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.64 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |