| Zacks Company Profile for Rocky Brands, Inc. (RCKY : NSDQ) |

|

|

| |

| • Company Description |

| Rocky Brands, Inc. is a leading designer, manufacturer and marketer of premium quality footwear and apparel marketed under a portfolio of well recognized brand names including Rocky Outdoor Gear, Georgia Boot, Durango, Lehigh, and the licensed brand, Dickies.

Number of Employees: 2,535 |

|

|

| |

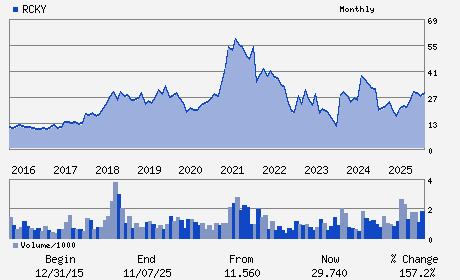

| • Price / Volume Information |

| Yesterday's Closing Price: $45.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 50,877 shares |

| Shares Outstanding: 7.49 (millions) |

| Market Capitalization: $338.71 (millions) |

| Beta: 2.61 |

| 52 Week High: $48.70 |

| 52 Week Low: $11.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

40.42% |

41.64% |

| 12 Week |

55.22% |

55.03% |

| Year To Date |

54.11% |

53.36% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

39 EAST CANAL STREET

-

NELSONVILLE,OH 45764

USA |

ph: 740-753-9100

fax: 740-753-4024 |

None |

http://www.rockybrands.com |

|

|

| |

| • General Corporate Information |

Officers

Jason S. Brooks - Chairman; President and Chief Executive Officer

Thomas D. Robertson - Chief Financial Officer; Chief Operating Officer a

Curtis A. Loveland - Assistant Secretary and Director

Michael L. Finn - Director

Robyn R. Hahn - Director

|

|

Peer Information

Rocky Brands, Inc. (RCSFY)

Rocky Brands, Inc. (BIRK)

Rocky Brands, Inc. (SRR)

Rocky Brands, Inc. (TBL)

Rocky Brands, Inc. (SHOO)

Rocky Brands, Inc. (DFZ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SHOES&REL APPRL

Sector: Consumer Discretionary

CUSIP: 774515100

SIC: 3140

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 7.49

Most Recent Split Date: (:1)

Beta: 2.61

Market Capitalization: $338.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.37% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.62 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.19 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/01/2025 - $0.16 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |