| Zacks Company Profile for Sturm, Ruger & Company, Inc. (RGR : NYSE) |

|

|

| |

| • Company Description |

| Sturm, Ruger & Co., Inc. is one of the nation's leading manufacturers of rugged, reliable firearms for the commercial sporting market. As a full-line manufacturer of American-made firearms, Ruger offers consumers of variations of the product lines, from the ubiquitous 10/22? and Mini-14?, to the new and exciting LCP? II, Mark IV?, Ruger American Pistol?, Ruger Precision Rifle?, SR-556 Takedown?, AR-556? and Ruger American Rifle?. Their awarding-winning products (the Gunsite Scout Rifle, SR9c?, LCR? and LCP?) all prove that Ruger has a rugged, reliable firearm to meet every shooter's needs. Ruger has been a model of corporate and community responsibility. Their motto, `Arms Makers for Responsible Citizens?,` echoes their commitment to these principles as they work hard to deliver quality and innovative firearms.

Number of Employees: 1,780 |

|

|

| |

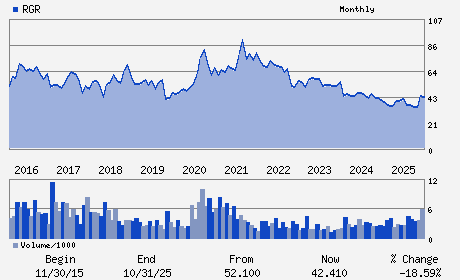

| • Price / Volume Information |

| Yesterday's Closing Price: $37.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 139,667 shares |

| Shares Outstanding: 15.94 (millions) |

| Market Capitalization: $596.95 (millions) |

| Beta: 0.19 |

| 52 Week High: $48.34 |

| 52 Week Low: $28.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.04% |

2.94% |

| 12 Week |

11.60% |

11.46% |

| Year To Date |

14.67% |

14.11% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

One Lacey Place

-

Southport,CT 06890

USA |

ph: 203-259-7843

fax: 203-256-3367 |

None |

http://www.ruger.com |

|

|

| |

| • General Corporate Information |

Officers

Christopher J. Killoy - Chief Executive Officer; Director

Thomas A. Dineen - Principal Financial Officer; Principal Accountin

Phillip C. Widman - Director

Sandra S. Froman - Director

Rebecca S. Halstead - Director

|

|

Peer Information

Sturm, Ruger & Company, Inc. (BAJAY)

Sturm, Ruger & Company, Inc. (ESCA)

Sturm, Ruger & Company, Inc. (GOYL)

Sturm, Ruger & Company, Inc. (FTSP)

Sturm, Ruger & Company, Inc. (KTO)

Sturm, Ruger & Company, Inc. (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: 864159108

SIC: 3480

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 15.94

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.19

Market Capitalization: $596.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.43% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.16 |

| Current Fiscal Year EPS Consensus Estimate: $2.07 |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |