| Zacks Company Profile for Reliance, Inc. (RS : NYSE) |

|

|

| |

| • Company Description |

| Reliance Inc. is a diversified metal solutions provider and metals service center company. It provides value-added metals processing services and distributes. Reliance Inc., formerly known as Reliance Steel & Aluminum Co., is based in SCOTTSDALE, Ariz.

Number of Employees: 15,700 |

|

|

| |

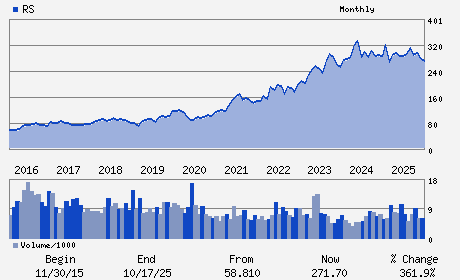

| • Price / Volume Information |

| Yesterday's Closing Price: $315.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 419,837 shares |

| Shares Outstanding: 52.29 (millions) |

| Market Capitalization: $16,503.86 (millions) |

| Beta: 0.91 |

| 52 Week High: $365.59 |

| 52 Week Low: $250.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.21% |

-3.37% |

| 12 Week |

10.43% |

10.30% |

| Year To Date |

9.27% |

8.74% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Karla R. Lewis - Chief Executive Officer and President

Douglas W. Stotlar - Chairman of the Board

Arthur Ajemyan - Senior Vice President and Chief Financial Officer

Lisa L. Baldwin - Director

Karen W. Colonias - Director

|

|

Peer Information

Reliance, Inc. (DMM.)

Reliance, Inc. (HNDNF)

Reliance, Inc. (ANUC)

Reliance, Inc. (CAU)

Reliance, Inc. (ENVG.)

Reliance, Inc. (EMEX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -MISC

Sector: Basic Materials

CUSIP: 759509102

SIC: 5051

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 52.29

Most Recent Split Date: 7.00 (2.00:1)

Beta: 0.91

Market Capitalization: $16,503.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.52% |

| Current Fiscal Quarter EPS Consensus Estimate: $4.60 |

Indicated Annual Dividend: $4.80 |

| Current Fiscal Year EPS Consensus Estimate: $18.14 |

Payout Ratio: 0.34 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.13 |

| Estmated Long-Term EPS Growth Rate: 9.22% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |