| Zacks Company Profile for RTX Corporation (RTX : NYSE) |

|

|

| |

| • Company Description |

| RTX Corporation is an aerospace and defense company. Its operating segments include Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. RTX Corporation, formerly known as Raytheon Technologies Corporation, is headquartered in Arlington, Virginia.

Number of Employees: 180,000 |

|

|

| |

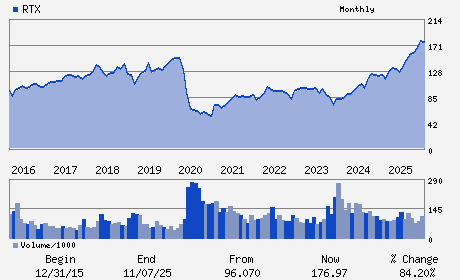

| • Price / Volume Information |

| Yesterday's Closing Price: $202.62 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,490,511 shares |

| Shares Outstanding: 1,342.29 (millions) |

| Market Capitalization: $271,974.31 (millions) |

| Beta: 0.42 |

| 52 Week High: $206.73 |

| 52 Week Low: $112.27 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.84% |

1.72% |

| 12 Week |

18.42% |

18.28% |

| Year To Date |

10.48% |

9.94% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1000 Wilson Boulevard

-

Arlington,VA 22209

USA |

ph: 781-522-3000

fax: 860-728-7028 |

investors@rtx.com |

http://www.rtx.com |

|

|

| |

| • General Corporate Information |

Officers

Christopher T. Calio - Chairman and Chief Executive Officer

Neil G. Mitchill - Executive Vice President and Chief Financial Offi

Ramsaran Maharajh - Executive Vice President and General Counsel

Amy L. Johnson - Senior Vice President; Controller

Dantaya M. Williams - Executive Vice President & Chief Human Resources O

|

|

Peer Information

RTX Corporation (BA)

RTX Corporation (HOVR)

RTX Corporation (HWM)

RTX Corporation (LMT)

RTX Corporation (TOD)

RTX Corporation (TXT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEFENSE

Sector: Aerospace

CUSIP: 75513E101

SIC: 3724

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 1,342.29

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.42

Market Capitalization: $271,974.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.34% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.51 |

Indicated Annual Dividend: $2.72 |

| Current Fiscal Year EPS Consensus Estimate: $6.81 |

Payout Ratio: 0.43 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: 10.16% |

Last Dividend Paid: 02/20/2026 - $0.68 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |