| Zacks Company Profile for Rush Enterprises, Inc. (RUSHA : NSDQ) |

|

|

| |

| • Company Description |

| Rush Enterprises operates the largest network of Peterbilt heavy-duty truck dealerships in North America and John Deere construction equipment dealerships in Texas and Michigan. Their current operations include a network of dealerships located in Texas, California, Oklahoma, Louisiana, Colorado, Arizona, New Mexico and Michigan. These dealerships provide an integrated, one-stop source for the retail sale of new and used heavy-duty trucks and construction equipment; aftermarket parts, service and body shop facilities; and a wide array of financial services.

Number of Employees: 7,355 |

|

|

| |

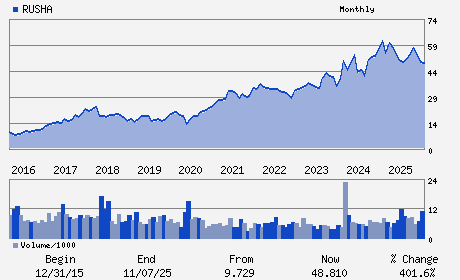

| • Price / Volume Information |

| Yesterday's Closing Price: $70.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 554,234 shares |

| Shares Outstanding: 77.08 (millions) |

| Market Capitalization: $5,470.47 (millions) |

| Beta: 0.91 |

| 52 Week High: $75.99 |

| 52 Week Low: $45.67 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.56% |

11.53% |

| 12 Week |

29.22% |

29.07% |

| Year To Date |

31.57% |

30.93% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

W. M. Rusty Rush - Chief Executive Officer; President and Chairman

Jason Wilder - Chief Operating Officer

Steven L. Keller - Chief Financial Officer and Treasurer

Thomas A. Akin - Director

Raymond J. Chess - Director

|

|

Peer Information

Rush Enterprises, Inc. (RVEE)

Rush Enterprises, Inc. (WKSP)

Rush Enterprises, Inc. (CRMT)

Rush Enterprises, Inc. (ACCA)

Rush Enterprises, Inc. (UGLY)

Rush Enterprises, Inc. (LAD)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RET/WHLSL AUTO/TRUCK

Sector: Retail/Wholesale

CUSIP: 781846209

SIC: 5500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 77.08

Most Recent Split Date: 8.00 (1.50:1)

Beta: 0.91

Market Capitalization: $5,470.47 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.07% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.90 |

Indicated Annual Dividend: $0.76 |

| Current Fiscal Year EPS Consensus Estimate: $4.25 |

Payout Ratio: 0.23 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 19.19% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |