| Zacks Company Profile for Banco Santander, S.A. (SAN : NYSE) |

|

|

| |

| • Company Description |

| Banco Santander SA is the biggest bank in Spain and the biggest international bank in Latin America as well. The Bank concentrates its activities in Andalucia, Castilla-Leon, Catalonia, Madrid, Valencia and Cantabria. The Bank provides banking services for individuals and companies, leasing, factoring, stockbrokerage and mutual fund services.

Number of Employees: 199,958 |

|

|

| |

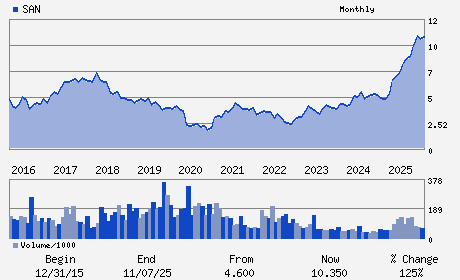

| • Price / Volume Information |

| Yesterday's Closing Price: $12.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 19,831,982 shares |

| Shares Outstanding: 14,885.33 (millions) |

| Market Capitalization: $183,982.62 (millions) |

| Beta: 0.71 |

| 52 Week High: $13.24 |

| 52 Week Low: $5.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.06% |

-2.21% |

| 12 Week |

12.67% |

12.53% |

| Year To Date |

5.37% |

4.86% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Hector Grisi - Chief executive officer

Ana Botin - Chairman

Bruce Carnegie-Brown - Vice Chairmen

Jose G. Cantera - Chief Financial Officer

Homaira Akbari - Director

|

|

Peer Information

Banco Santander, S.A. (BKAU)

Banco Santander, S.A. (BKEAY)

Banco Santander, S.A. (BKNIY)

Banco Santander, S.A. (BKJAY)

Banco Santander, S.A. (ABNYY)

Banco Santander, S.A. (BNSTY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-FOREIGN

Sector: Finance

CUSIP: 05964H105

SIC: 6029

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 14,885.33

Most Recent Split Date: 11.00 (1.06:1)

Beta: 0.71

Market Capitalization: $183,982.62 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.53% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.28 |

Indicated Annual Dividend: $0.19 |

| Current Fiscal Year EPS Consensus Estimate: $1.11 |

Payout Ratio: 0.20 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: 14.90% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |