| Zacks Company Profile for Southern Copper Corporation (SCCO : NYSE) |

|

|

| |

| • Company Description |

| Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals. The company conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru. Southern Copper has the largest copper reserves in the industry and operates high-quality, world-class assets in investment grade countries, such as Mexico and Peru.?

Number of Employees: 16,133 |

|

|

| |

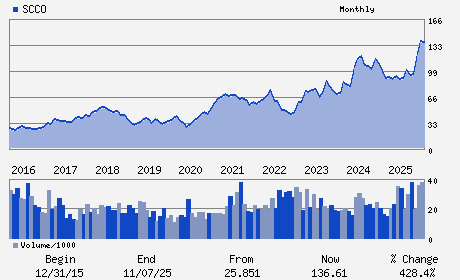

| • Price / Volume Information |

| Yesterday's Closing Price: $218.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,961,402 shares |

| Shares Outstanding: 812.19 (millions) |

| Market Capitalization: $177,301.48 (millions) |

| Beta: 1.03 |

| 52 Week High: $223.89 |

| 52 Week Low: $72.17 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.70% |

15.70% |

| 12 Week |

55.47% |

55.28% |

| Year To Date |

52.16% |

51.42% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Oscar Gonzalez Rocha - Chief Executive Officer and President

German Larrea Mota-Velasco - Chairman of the Board; and Director

Raul Jacob Ruisanchez - Vice President; Finance; Treasurer and Chief Finan

Julian Jorge Lazalde Psihas - Secretary

L. Miguel Palomino Bonilla - Director

|

|

Peer Information

Southern Copper Corporation (CDE)

Southern Copper Corporation (SNKTY)

Southern Copper Corporation (THRA)

Southern Copper Corporation (FCX.A)

Southern Copper Corporation (AL.)

Southern Copper Corporation (ACMBB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -NON FERR

Sector: Basic Materials

CUSIP: 84265V105

SIC: 1000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 812.19

Most Recent Split Date: 5.00 (1.01:1)

Beta: 1.03

Market Capitalization: $177,301.48 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.83% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.88 |

Indicated Annual Dividend: $4.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.57 |

Payout Ratio: 0.68 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.20 |

| Estmated Long-Term EPS Growth Rate: 14.74% |

Last Dividend Paid: 02/10/2026 - $1.00 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |