| Zacks Company Profile for Scholastic Corporation (SCHL : NSDQ) |

|

|

| |

| • Company Description |

| Scholastic Corporation is the world's largest publisher and distributor of children's books and a leader in educational technology and children's media. Scholastic creates quality educational and entertaining materials and products for use in school and at home, including children's books, magazines, technology-based products, teacher materials, television programming, film, videos and toys. The Company distributes its products and services through a variety of channels, including proprietary school-based book clubs and school-based book fairs, retail stores, schools, libraries & television networks. The company distributes its products and services directly to schools and libraries through retail stores and the Internet.

Number of Employees: 7,090 |

|

|

| |

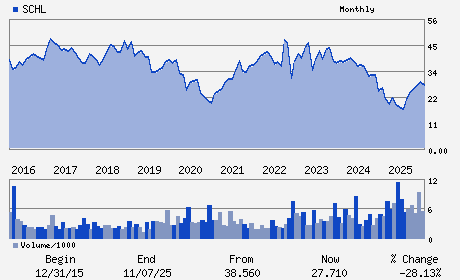

| • Price / Volume Information |

| Yesterday's Closing Price: $34.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 383,525 shares |

| Shares Outstanding: 25.44 (millions) |

| Market Capitalization: $884.61 (millions) |

| Beta: 1.17 |

| 52 Week High: $35.98 |

| 52 Week Low: $15.77 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.57% |

0.30% |

| 12 Week |

22.39% |

22.24% |

| Year To Date |

17.35% |

16.78% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter Warwick - Chief Executive Officer; President and Director

Iole Lucchese - Chair of the Board of Directors

Haji L. Glover - Executive Vice President and Chief Financial Offic

Paul Hukkanen - Senior Vice President and Chief Accounting Officer

Andres Alonso - Director

|

|

Peer Information

Scholastic Corporation (GWOX)

Scholastic Corporation (PDYPY)

Scholastic Corporation (AMEP)

Scholastic Corporation (TNMB)

Scholastic Corporation (SCHL)

Scholastic Corporation (HTN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PUBLSHG-BOOKS

Sector: Consumer Staples

CUSIP: 807066105

SIC: 2731

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/19/26

|

|

Share - Related Items

Shares Outstanding: 25.44

Most Recent Split Date: 1.00 (2.00:1)

Beta: 1.17

Market Capitalization: $884.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.60 |

Indicated Annual Dividend: $0.80 |

| Current Fiscal Year EPS Consensus Estimate: $1.43 |

Payout Ratio: 0.92 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/30/2026 - $0.20 |

| Next EPS Report Date: 03/19/26 |

|

|

|

| |