| Zacks Company Profile for ScanSource, Inc. (SCSC : NSDQ) |

|

|

| |

| • Company Description |

| ScanSource, Inc. serves North America as a value-added distributor of specialty technologies, including automatic identification and point-of-sale products, and business telephone products. Serving only the value added reseller, ScanSource is committed to growing specialty technology markets by strengthening and enlarging the value added reseller channel. ScanSource's commitment to value added resellers includes offering a broad product selection, competitive pricing, fast delivery, technical support, sales training, customer financing and qualified leads.

Number of Employees: 2,100 |

|

|

| |

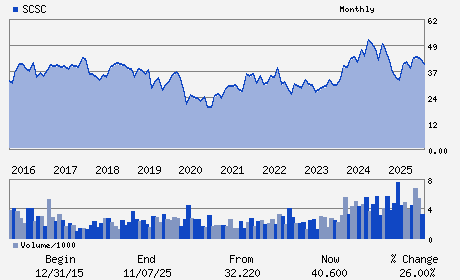

| • Price / Volume Information |

| Yesterday's Closing Price: $37.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 262,660 shares |

| Shares Outstanding: 21.48 (millions) |

| Market Capitalization: $798.64 (millions) |

| Beta: 1.28 |

| 52 Week High: $46.25 |

| 52 Week Low: $28.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-12.64% |

-11.88% |

| 12 Week |

-10.19% |

-10.87% |

| Year To Date |

-4.81% |

-5.69% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael L. Baur - Chief Executive Officer and Chairman

Steve Jones - Senior Executive Vice President and Chief Financia

Brandy Ford - Senior Vice President and Chief Accounting Officer

Peter C. Browning - Lead Independent Director

Charles A. Mathis - Director

|

|

Peer Information

ScanSource, Inc. (EVOL)

ScanSource, Inc. (RAMP)

ScanSource, Inc. (LGTY)

ScanSource, Inc. (ALOT)

ScanSource, Inc. (CXT)

ScanSource, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 806037107

SIC: 5045

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 21.48

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.28

Market Capitalization: $798.64 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.91 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.94 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 15.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |