| Zacks Company Profile for Shake Shack, Inc. (SHAK : NYSE) |

|

|

| |

| • Company Description |

| Shake Shack, Inc. is a New York-based fast food hamburger restaurant chain. Shake Shack restaurants operate in the United States and internationally. It is one of the nation's largest hamburger chains offering beef burgers, flat-top dogs, chicken sandwiches, frozen custard and crinkle cut and other food items.

Number of Employees: 13,873 |

|

|

| |

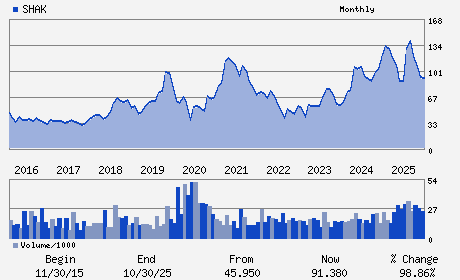

| • Price / Volume Information |

| Yesterday's Closing Price: $96.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,464,886 shares |

| Shares Outstanding: 42.69 (millions) |

| Market Capitalization: $4,098.51 (millions) |

| Beta: 1.73 |

| 52 Week High: $144.65 |

| 52 Week Low: $72.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.40% |

9.35% |

| 12 Week |

23.04% |

22.89% |

| Year To Date |

18.28% |

17.71% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert Lynch - Chief Executive Officer and Director

Daniel Meyer - Chairman

Peter Herpich - Chief Financial Officer

Sumaiya Balbale - Director

Charles J. Chapman - Director

|

|

Peer Information

Shake Shack, Inc. (BH)

Shake Shack, Inc. (BUCA)

Shake Shack, Inc. (BUNZQ)

Shake Shack, Inc. (FRRG)

Shake Shack, Inc. (CHEF.)

Shake Shack, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 819047101

SIC: 5810

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 42.69

Most Recent Split Date: (:1)

Beta: 1.73

Market Capitalization: $4,098.51 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.14 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.36 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 23.41% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |