| Zacks Company Profile for AB SKF (SKFRY : OTC) |

|

|

| |

| • Company Description |

| SKF AB engages in the manufacturing of ball and roller bearings, seals, tools for mounting/dismounting bearings, lubricants and measuring/monitoring instruments. It also produces roller bearing steel and other special steels. The Company operates in three divisions: Industrial Division, Service Division and Automotive Division. It also offers products and knowledge-based services comprising hardware and software, consulting, mechanical services, predictive and preventive maintenance, condition monitoring, decision-support systems and performance-based contracts. SKF AB is headquartered in Gothenburg, Sweden.

Number of Employees: 38,426 |

|

|

| |

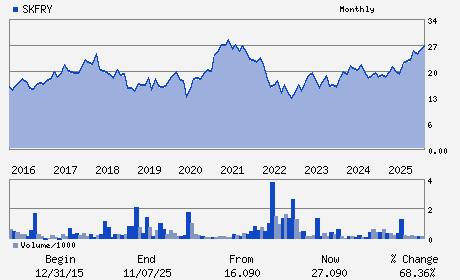

| • Price / Volume Information |

| Yesterday's Closing Price: $28.66 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,704 shares |

| Shares Outstanding: 455.35 (millions) |

| Market Capitalization: $13,050.36 (millions) |

| Beta: 1.13 |

| 52 Week High: $29.41 |

| 52 Week Low: $15.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.54% |

10.49% |

| 12 Week |

5.64% |

5.51% |

| Year To Date |

8.23% |

7.71% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

SE 415 50 SVEN WINGQVISTS GATA 2

-

GOTHENBURG,V7 415 50

SWE |

ph: 46-3-133-710-00

fax: 46-3-133-728-32 |

sophie.arnius@skf.com |

http://www.skf.com |

|

|

| |

| • General Corporate Information |

Officers

Rickard Gustafson - President and Chief Executive Officer

Hans Straberg - Chairman

Hakan Buskhe - Vice Chairman

Susanne Larsson - Chief Financial Officer and Senior Vice President

Hock Goh - Director

|

|

Peer Information

AB SKF (DVLGQ)

AB SKF (CNM)

AB SKF (FLOW.)

AB SKF (AMDLY)

AB SKF (HURC)

AB SKF (LECO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH TLS&RL PRD

Sector: Industrial Products

CUSIP: 784375404

SIC: 3562

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 455.35

Most Recent Split Date: 5.00 (4.00:1)

Beta: 1.13

Market Capitalization: $13,050.36 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.54% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.45 |

Indicated Annual Dividend: $0.73 |

| Current Fiscal Year EPS Consensus Estimate: $1.93 |

Payout Ratio: 0.42 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.06 |

| Estmated Long-Term EPS Growth Rate: 7.79% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |