| Zacks Company Profile for SkyWest, Inc. (SKYW : NSDQ) |

|

|

| |

| • Company Description |

| SkyWest operates as a regional airline in the U.S. through its subsidiary SkyWest Airlines. SkyWest is also the holding company of an aircraft leasing company. It offers high-quality regional service to airports located primarily in the Midwestern and Western United States as well as Mexico and Canada. Offering scheduled regional airline service under code-share agreements with its airline partners, forms the basis of the company's operating model. On a daily basis, SkyWest is responsible for operating more than 2,100 flights to multiple destinations in N. America. SkyWest provides regional operations to its major airline partners under long-term, fixed-fee, code-share agreements. The company has codeshare agreements with key airline players like Delta Air Lines, American Airlines, United and Alaska Airlines. The fixed-fee agreement with these companies obligate the respective major airline partner to refund the amount of fuel costs SkyWest incurs under those agreements.

Number of Employees: 15,775 |

|

|

| |

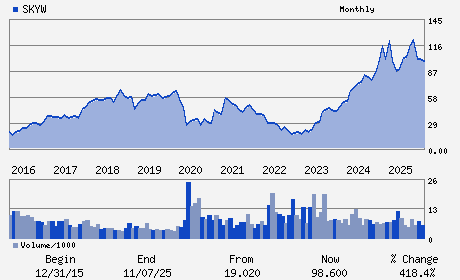

| • Price / Volume Information |

| Yesterday's Closing Price: $104.08 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 256,731 shares |

| Shares Outstanding: 40.41 (millions) |

| Market Capitalization: $4,205.53 (millions) |

| Beta: 1.58 |

| 52 Week High: $123.94 |

| 52 Week Low: $74.70 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.83% |

8.78% |

| 12 Week |

0.66% |

0.53% |

| Year To Date |

3.65% |

3.15% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Russell A. Childs - Chief Executive Officer and President

James L. Welch - Chairman of the Board

Robert J. Simmons - Chief Financial Officer

Eric J. Woodward - Chief Accounting Officer

Smita Conjeevaram - Lead Director

|

|

Peer Information

SkyWest, Inc. (ATAHQ)

SkyWest, Inc. (CEA)

SkyWest, Inc. (ICAGY)

SkyWest, Inc. (ALK)

SkyWest, Inc. (HELK)

SkyWest, Inc. (GLUX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-AIRLINE

Sector: Transportation

CUSIP: 830879102

SIC: 4512

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 40.41

Most Recent Split Date: 12.00 (2.00:1)

Beta: 1.58

Market Capitalization: $4,205.53 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.19 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $11.42 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 13.11% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |