| Zacks Company Profile for AsiaStrategy (SORA : NSDQ) |

|

|

| |

| • Company Description |

| AsiaStrategy, together with its subsidiaries, engages in trading, distribution and retail of luxury watches principally in Hong Kong. The company sells its products under the Omega, Cartier, Rolex, Longines, Audermars Piguet, Patek Philippe, Blancpain, Casio, Breguet and Hublot brands. AsiaStrategy, formerly known as Top Win International Limited, is based in Wan Chai, Hong Kong.

Number of Employees: 7 |

|

|

| |

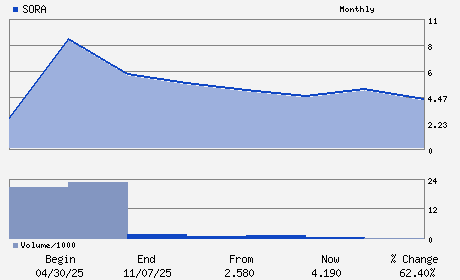

| • Price / Volume Information |

| Yesterday's Closing Price: $1.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 358,764 shares |

| Shares Outstanding: 24.86 (millions) |

| Market Capitalization: $48.49 (millions) |

| Beta: |

| 52 Week High: $14.15 |

| 52 Week Low: $1.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.17% |

11.13% |

| 12 Week |

-49.22% |

-49.28% |

| Year To Date |

-36.07% |

-36.38% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

33/F SUNSHINE PLAZA 353 LOCKHART ROAD WAN CHAI

-

HONG KONG,K3 000000

HKG |

ph: 852-2815-7988

fax: - |

None |

https://topw.com.hk |

|

|

| |

| • General Corporate Information |

Officers

Kwan, NGAI - Chief Executive Officer and Director

Man Wa Claudia, HO - Chief Operating Officer

Fung Yee Mary, WONG - Chief Financial Officer and Director

Xiao Jun, WANG - Director

Jung Hui YEN - Director

|

|

Peer Information

AsiaStrategy (BAJAY)

AsiaStrategy (ESCA)

AsiaStrategy (GOYL)

AsiaStrategy (FTSP)

AsiaStrategy (KTO)

AsiaStrategy (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: G8946B108

SIC: 5094

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 24.86

Most Recent Split Date: (:1)

Beta:

Market Capitalization: $48.49 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |