| Zacks Company Profile for Sturgis Bancorp Inc. (STBI : OTC) |

|

|

| |

| • Company Description |

| STURGIS BCP INC offers a wide array of deposit products to meet the needs of families and small businesses. Sturgis Bank & Trust Company wants to meet the credit needs of its community. The Bank offers the following types of loans: Home Mortgages, Prime Equity Plus, Credit Life/Accident and Health Insurance, Construction Loans, Automobile Loans, Boat Loans, Recreational Vehicle, Mobile Home Loans, Personal Loans, Educational Loans, Consumer Loans, Commercial Mortgage and Non-Mortgage Loans.

Number of Employees: |

|

|

| |

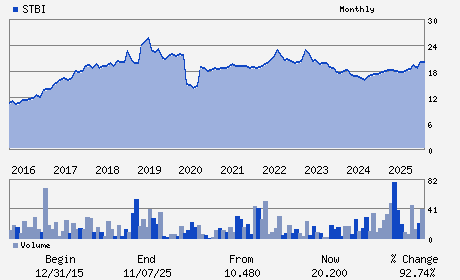

| • Price / Volume Information |

| Yesterday's Closing Price: $23.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,212 shares |

| Shares Outstanding: 2.17 (millions) |

| Market Capitalization: $49.88 (millions) |

| Beta: 0.12 |

| 52 Week High: $23.50 |

| 52 Week Low: $16.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.28% |

8.21% |

| 12 Week |

12.74% |

12.61% |

| Year To Date |

7.23% |

6.71% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

113-125 E CHICAGO ROAD

-

STURGIS,MI 49091

USA |

ph: 616-651-9345

fax: 616-651-5512 |

None |

http://www.sturgisbank.com |

|

|

| |

| • General Corporate Information |

Officers

Lawrence A. Franks - Director; Chairman

Eric L. Eishen - Director; President and Chief Executive Officer

Brian P. Hoggatt - Chief Financial Officer ;Secretary/Treasurer

nald L. Frost - Director

Philip G. Ward - Director

|

|

Peer Information

Sturgis Bancorp Inc. (ABBK)

Sturgis Bancorp Inc. (ABCWQ)

Sturgis Bancorp Inc. (BDJI)

Sturgis Bancorp Inc. (COOPQ)

Sturgis Bancorp Inc. (CITZ)

Sturgis Bancorp Inc. (BKC.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FIN-SVGS & LOAN

Sector: Finance

CUSIP: 864087101

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 2.17

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.12

Market Capitalization: $49.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.13% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.72 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.20 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.23 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/13/2026 - $0.18 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |