| Zacks Company Profile for Sterling Infrastructure, Inc. (STRL : NSDQ) |

|

|

| |

| • Company Description |

| Sterling Infrastructure Inc. operates through subsidiaries within segments specializing in E-Infrastructure, Building and Transportation Solutions principally in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and the Rocky Mountain States, California and Hawaii. E-Infrastructure Solutions projects develop advanced, large-scale site development systems and services for data centers, e-commerce distribution centers, warehousing, transportation, energy and more. Building Solutions projects include residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs and other concrete work. Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail, water, wastewater and storm drainage systems. Sterling Infrastructure Inc., formerly known as Sterling Construction Company Inc., is based in THE WOODLANDS, Texas.

Number of Employees: 3,000 |

|

|

| |

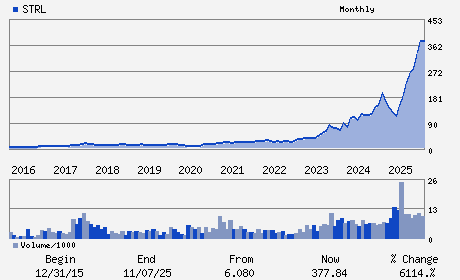

| • Price / Volume Information |

| Yesterday's Closing Price: $428.13 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 548,346 shares |

| Shares Outstanding: 30.72 (millions) |

| Market Capitalization: $13,151.73 (millions) |

| Beta: 1.51 |

| 52 Week High: $477.03 |

| 52 Week Low: $96.34 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.89% |

14.37% |

| 12 Week |

28.84% |

28.44% |

| Year To Date |

39.81% |

40.21% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Joseph A. Cutillo - Chief Executive Officer;Director

Roger A. Cregg - Chairman and Director

Daniel P. Govin - Chief Operating Officer

Nicholas Grindstaff - Chief Financial Officer

Julie A. Dill - Director

|

|

Peer Information

Sterling Infrastructure, Inc. (TURN)

Sterling Infrastructure, Inc. (FWLT)

Sterling Infrastructure, Inc. (CTAK)

Sterling Infrastructure, Inc. (AVNA)

Sterling Infrastructure, Inc. (NLX.)

Sterling Infrastructure, Inc. (T.AGR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ENGINRG/R&D SVS

Sector: Construction

CUSIP: 859241101

SIC: 1600

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 30.72

Most Recent Split Date: (:1)

Beta: 1.51

Market Capitalization: $13,151.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $11.67 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 15.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |