| Zacks Company Profile for SUMCO (SUOPY : OTC) |

|

|

| |

| • Company Description |

| Sumco Corporation manufactures and sells silicon wafers for the semiconductor industry. It offers monocrystalline ingots, polished wafers, annealed wafers, epitaxial wafers, junction isolated wafers, silicon-on-insulator wafers, and reclaimed polished wafers. The company operates primarily in Japan, North America, Asia and Europe. Sumco Corporation is headquartered in Tokyo, Japan.

Number of Employees: 9,847 |

|

|

| |

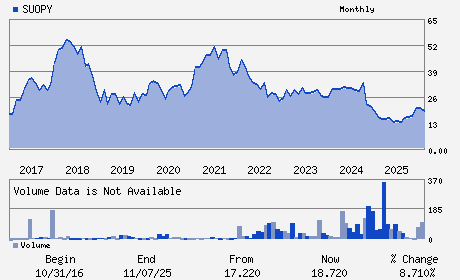

| • Price / Volume Information |

| Yesterday's Closing Price: $23.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,710 shares |

| Shares Outstanding: 174.86 (millions) |

| Market Capitalization: $4,074.15 (millions) |

| Beta: 1.06 |

| 52 Week High: $24.15 |

| 52 Week Low: $10.29 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.95% |

11.92% |

| 12 Week |

35.15% |

34.98% |

| Year To Date |

31.27% |

30.63% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Seavans North 1-2-1 Shibaura Minato-ku

-

Tokyo,M0 105-8634

JPN |

ph: 813-5444-0808

fax: - |

None |

http://www.sumcosi.com |

|

|

| |

| • General Corporate Information |

Officers

Mayuki Hashimoto - Chief Executive Officer and Chairman

Toshihiro Awa - President

Jiro Ryuta - Executive Vice President

Shinichi Kubozoe - Director

Takeo Katoh - Director

|

|

Peer Information

SUMCO (XCRA)

SUMCO (INTC)

SUMCO (NVDA)

SUMCO (TXN)

SUMCO (ISIL)

SUMCO (SUOPY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-GENERAL

Sector: Computer and Technology

CUSIP: 86558P109

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 174.86

Most Recent Split Date: (:1)

Beta: 1.06

Market Capitalization: $4,074.15 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.39% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.09 |

| Current Fiscal Year EPS Consensus Estimate: $-0.60 |

Payout Ratio: 0.59 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.32 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |