| Zacks Company Profile for Sypris Solutions, Inc. (SYPR : NSDQ) |

|

|

| |

| • Company Description |

| Sypris Solutions, Inc. is a diversified provider of technology-basedoutsource services and specialized industrial products. They perform awide range of manufacturing and technical services, typically under long-term contracts with major manufacturers. They also manufacture and sell complex data storage systems, magnetic instruments, current sensors, high-pressure closures and a variety of other industrial products.

Number of Employees: 713 |

|

|

| |

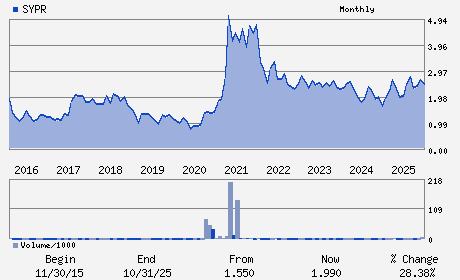

| • Price / Volume Information |

| Yesterday's Closing Price: $2.96 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 149,876 shares |

| Shares Outstanding: 23.03 (millions) |

| Market Capitalization: $68.17 (millions) |

| Beta: 0.84 |

| 52 Week High: $4.74 |

| 52 Week Low: $1.42 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.21% |

-2.95% |

| 12 Week |

42.31% |

41.86% |

| Year To Date |

21.31% |

28.73% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

101 BULLITT LN STE 450

-

LOUISVILLE,KY 40222

USA |

ph: 502-329-2000

fax: 502-329-2050 |

ir@sypris.com |

http://www.sypris.com |

|

|

| |

| • General Corporate Information |

Officers

Jeffrey T. Gill - Chairman; President and Chief Executive Officer

Rebecca R. Eckert - Vice President; Chief Accounting Officer and Contr

Gary L. Convis - Director

William G. Ferko - Director

R. Scott Gill - Director

|

|

Peer Information

Sypris Solutions, Inc. (SYPR)

Sypris Solutions, Inc. (LINK)

Sypris Solutions, Inc. (BBOX)

Sypris Solutions, Inc. (BLNK)

Sypris Solutions, Inc. (ADSE)

Sypris Solutions, Inc. (SCLE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC MISC SERVICES

Sector: Computer and Technology

CUSIP: 871655106

SIC: 3823

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 23.03

Most Recent Split Date: 3.00 (0.25:1)

Beta: 0.84

Market Capitalization: $68.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |