| Zacks Company Profile for Suzuki Motor (SZKMY : OTC) |

|

|

| |

| • Company Description |

| Suzuki Motor Corporation manufactures and markets motorcycles, automobiles and marine and power products. It provides terrain vehicles, mini-vehicles, sub-compact vehicles, standard-sized vehicles, outboard motors, engines for snowmobiles, electro senior vehicles and houses, as well as boats, motorized wheelchairs, electro-scooters, industrial equipment. The company operates primarily in Japan, Europe, Asia and internationally. Suzuki Motor Corporation is headquartered in Hamamatsu, Japan.

Number of Employees: 74,077 |

|

|

| |

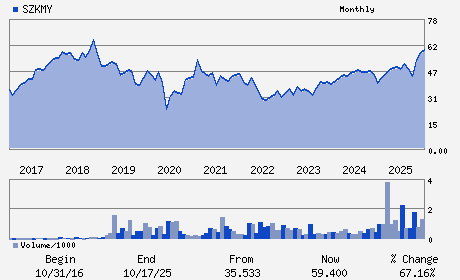

| • Price / Volume Information |

| Yesterday's Closing Price: $60.24 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 43,442 shares |

| Shares Outstanding: 491.15 (millions) |

| Market Capitalization: $29,586.67 (millions) |

| Beta: 0.45 |

| 52 Week High: $64.54 |

| 52 Week Low: $39.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.75% |

10.71% |

| 12 Week |

1.41% |

1.29% |

| Year To Date |

1.88% |

1.38% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

300 Takatsuka-Cho Minami-Ku

-

Hamamatsu,M0 432-8611

JPN |

ph: 815-3440-2904

fax: - |

None |

http://www.suzuki.co.jp |

|

|

| |

| • General Corporate Information |

Officers

ToshihiroSuzuki - President

Naomi Ishii - Executive Vice President

Kenichi Ayukawa - Executive Vice President

Katsuhiro Kato - Director

Shigetoshi Torii - Director

|

|

Peer Information

Suzuki Motor (DIN.L)

Suzuki Motor (SSM)

Suzuki Motor (FIATY)

Suzuki Motor (FUJHY)

Suzuki Motor (BAMXF)

Suzuki Motor (BRDCY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO -FOREIGN

Sector: Auto/Tires/Trucks

CUSIP: 86959X107

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 491.15

Most Recent Split Date: 4.00 (4.00:1)

Beta: 0.45

Market Capitalization: $29,586.67 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.26% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.76 |

| Current Fiscal Year EPS Consensus Estimate: $5.35 |

Payout Ratio: 0.13 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |