| Zacks Company Profile for AT&T Inc. (T : NYSE) |

|

|

| |

| • Company Description |

| AT&T Inc. is the second largest wireless service provider in North America and one of the world's leading communications service carriers. Through its subsidiaries and affiliates, the company offers a wide range of communication and business solutions that include wireless, local exchange, long-distance, data/broadband and Internet, video, managed networking, wholesale and cloud-based services. With assets like HBO, CNN and TNT, AT&T's acquisition of Time Warner has created new kinds of online videos and opened up avenues for targeted advertisements. The company is also focusing on streaming services with AT&T TV and HBO Max. This is likely to create other avenues to monetize content as it expands 5G coverage across the country.

Number of Employees: 133,030 |

|

|

| |

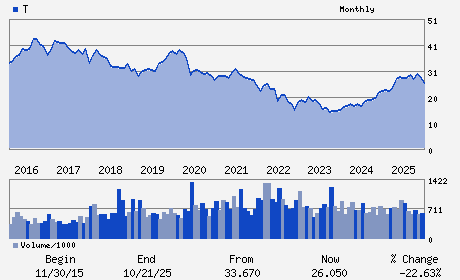

| • Price / Volume Information |

| Yesterday's Closing Price: $28.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 41,846,232 shares |

| Shares Outstanding: 7,000.58 (millions) |

| Market Capitalization: $196,086.17 (millions) |

| Beta: 0.39 |

| 52 Week High: $29.79 |

| 52 Week Low: $22.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.87% |

7.80% |

| 12 Week |

10.80% |

10.66% |

| Year To Date |

12.76% |

12.21% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

208 S. AKARD ST

-

DALLAS,TX 75202

USA |

ph: 210-821-4105

fax: 302-655-5049 |

investr@att.com |

http://www.att.com |

|

|

| |

| • General Corporate Information |

Officers

John T. Stankey - Chief Executive Officer; Chairman and President

Jeffery S. McElfresh - Chief Operating Officer

Pascal Desroches - Senior Executive Vice President and Chief Financia

David R. McAtee II - Senior Executive Vice President and General Counse

Sabrina Sanders - Senior Vice President; Chief Accounting Officer

|

|

Peer Information

AT&T Inc. (UATG)

AT&T Inc. (ELWT)

AT&T Inc. (GSMI)

AT&T Inc. (LCCI)

AT&T Inc. (T)

AT&T Inc. (MCOMQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless National

Sector: Computer and Technology

CUSIP: 00206R102

SIC: 4813

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 7,000.58

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.39

Market Capitalization: $196,086.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.96% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.55 |

Indicated Annual Dividend: $1.11 |

| Current Fiscal Year EPS Consensus Estimate: $2.31 |

Payout Ratio: 0.53 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 11.67% |

Last Dividend Paid: 01/12/2026 - $0.28 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |