| Zacks Company Profile for Thunder Mountain Gold Inc. (THMG : OTC) |

|

|

| |

| • Company Description |

| Thunder Mountain Gold, Inc. is a mineral exploration stage company with no producing mines. The Company focuses in the business of exploring for mining properties that have the potential to produce gold, silver, base metals and other commodities. The company performs its own natural resource exploration and generates value for shareholders by aggressively developing high-grade, high-quality precious and base metal resources in politically stable mining regions. The Company, including its subsidiaries, owns rights to claims and properties in the mining areas of Nevada, Idaho and Arizona. The Company owns 100% of the outstanding stock of Thunder Mountain Resources, Inc., a Nevada Corporation. Thunder Mountain Resources, Inc. owns 100% of the outstanding stock of South Mountain Mines, Inc., an Idaho Corporation. South Mountain Mines, Inc. owns the South Mountain Project. Thunder Mountain Gold, Inc. is based in Elko, Nevada.

Number of Employees: 4 |

|

|

| |

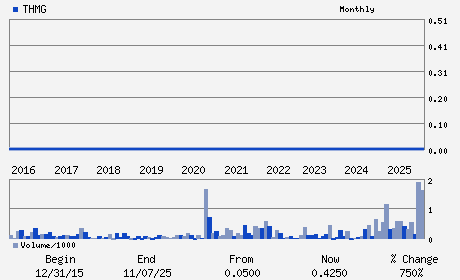

| • Price / Volume Information |

| Yesterday's Closing Price: $0.88 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 33,643 shares |

| Shares Outstanding: 93.26 (millions) |

| Market Capitalization: $82.07 (millions) |

| Beta: 0.38 |

| 52 Week High: $1.01 |

| 52 Week Low: $0.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.43% |

15.44% |

| 12 Week |

1.15% |

1.02% |

| Year To Date |

21.38% |

20.79% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

11770 W President Drive STE F

-

BOISE,ID 83713

USA |

ph: 208-658-1037

fax: 208-322-5626 |

None |

http://www.thundermountaingold.com |

|

|

| |

| • General Corporate Information |

Officers

Eric T. Jones - Chief Executive Officer and President

Ron Espell - Chief Operating Officer

Larry Thackery - Chief Financial Officer

Paul Beckman - Director

Ralph Noyes - Director

|

|

Peer Information

- (-)

- (-)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -NON FERR

Sector: Basic Materials

CUSIP: 886043108

SIC: 1000

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 93.26

Most Recent Split Date: (:1)

Beta: 0.38

Market Capitalization: $82.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |