| Zacks Company Profile for TKO Group Holdings, Inc. (TKO : NYSE) |

|

|

| |

| • Company Description |

| World Wrestling Entertainment Inc. or WWE is primarily engaged in the production and distribution of unique and creative content via myriad channels, including the premium over-the-top network monetized through license arrangements or through direct-to-consumer subscriptions, content rights agreements, premium live event programming and the sale of consumer products featuring brands. The company leverages the Internet and social media platforms to promote brands, market and distribute content and digital products. The three reportable segments are - The Media segment is engaged in the production and monetization of video content across various platforms, comprising WWE Network, pay television, digital and social media and filmed entertainment. The Live Events segment generates revenues from ticket sales along with travel packages for live events. The Consumer Products segment is engaged in the merchandising of WWE branded products that includes video games, toys and apparel.

Number of Employees: 4,000 |

|

|

| |

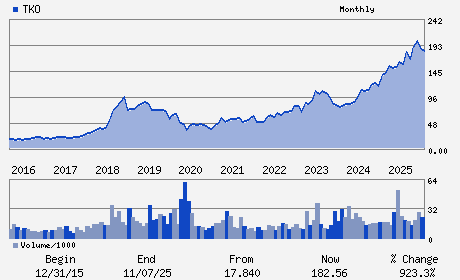

| • Price / Volume Information |

| Yesterday's Closing Price: $223.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 803,636 shares |

| Shares Outstanding: 195.08 (millions) |

| Market Capitalization: $43,672.78 (millions) |

| Beta: 0.66 |

| 52 Week High: $226.94 |

| 52 Week Low: $133.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.51% |

11.48% |

| 12 Week |

10.71% |

10.57% |

| Year To Date |

7.11% |

6.60% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

200 FIFTH AVE 7TH FLOOR

-

NEW YORK,NY 10010

USA |

ph: 646-558-8333

fax: 203-359-5151 |

investor@tkogrp.com |

https://tkogrp.com |

|

|

| |

| • General Corporate Information |

Officers

Ariel Emanuel - Executive Chairman and Chief Executive Officer

Mark Shapiro - President and Chief Operating Officer

Andrew Schleimer - Chief Financial Officer

Peter C.B. Bynoe - Director

Egon P. Durban - Director

|

|

Peer Information

TKO Group Holdings, Inc. (BDLN)

TKO Group Holdings, Inc. (M.IMX)

TKO Group Holdings, Inc. (AFTC.)

TKO Group Holdings, Inc. (CELC.)

TKO Group Holdings, Inc. (CCTVY)

TKO Group Holdings, Inc. (NLMP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MOVIE/TV PRD&DIST

Sector: Consumer Discretionary

CUSIP: 87256C101

SIC: 7900

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 195.08

Most Recent Split Date: (:1)

Beta: 0.66

Market Capitalization: $43,672.78 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.39% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.20 |

Indicated Annual Dividend: $3.12 |

| Current Fiscal Year EPS Consensus Estimate: $5.29 |

Payout Ratio: 1.37 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 1.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.78 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |