| Zacks Company Profile for TriNet Group, Inc. (TNET : NYSE) |

|

|

| |

| • Company Description |

| TriNet Group, Inc. is a provider of a comprehensive human resources solution for small to medium-sized businesses. It offers payroll, tax administration, risk protection, performance management, compensation consulting, and employee benefit plans. The Company serves banking and financial services, biotech and life sciences, technology, non-profits, professional services, venture capital, and advertising and marketing industries. TriNet Group, Inc. is headquartered in San Leandro, California.

Number of Employees: 3,400 |

|

|

| |

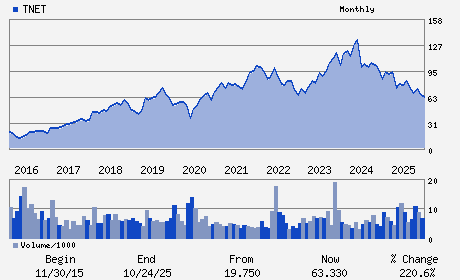

| • Price / Volume Information |

| Yesterday's Closing Price: $41.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 585,324 shares |

| Shares Outstanding: 47.30 (millions) |

| Market Capitalization: $1,975.21 (millions) |

| Beta: 0.81 |

| 52 Week High: $88.56 |

| 52 Week Low: $38.61 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-31.12% |

-31.59% |

| 12 Week |

-29.00% |

-29.81% |

| Year To Date |

-29.38% |

-29.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael Q. Simonds - Chief Executive Officer

Mala Murthy - Chief Financial Officer

Michael J. Angelakis - Director

Paul Chamberlain - Director

Ralph Clark - Director

|

|

Peer Information

TriNet Group, Inc. (CGEMY)

TriNet Group, Inc. (GLXG)

TriNet Group, Inc. (SRT)

TriNet Group, Inc. (CVG)

TriNet Group, Inc. (HEW)

TriNet Group, Inc. (BBSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Outsourcing

Sector: Business Services

CUSIP: 896288107

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 47.30

Most Recent Split Date: (:1)

Beta: 0.81

Market Capitalization: $1,975.21 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.63% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.98 |

Indicated Annual Dividend: $1.10 |

| Current Fiscal Year EPS Consensus Estimate: $3.98 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.21 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/02/2026 - $0.28 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |