| Zacks Company Profile for TripAdvisor, Inc. (TRIP : NSDQ) |

|

|

| |

| • Company Description |

| TripAdvisor, Inc., being one of the largest online travel research companies in the world, provides a platform for users to share reviews, ratings and opinions on hotels, destinations, attractions and restaurants. The company also facilitates bookings between hotel suppliers and consumers using its web portals. It provides services in the U.S. through the tripadvisor.com website. Further, a localized version of this website is available in multiple languages across the world. In addition to the flagship TripAdvisor website, the company operates websites under a large number of other travel media brands. The business operates using a meta-search platform that allows users to compare hotel pricing and availability. The company earns a certain amount from advertisers. TripAdvisor classifies its revenue streams into three basic categories: Hotels, Media & Platform, Experiences & Dining, and Other revenues. The Hotels, Media & Platform makes up the primary source of its revenues.

Number of Employees: 2,590 |

|

|

| |

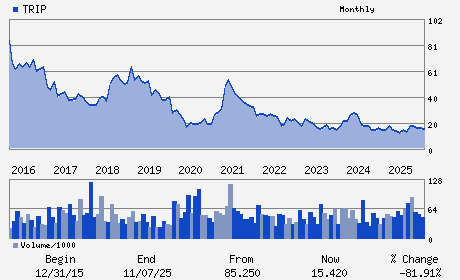

| • Price / Volume Information |

| Yesterday's Closing Price: $10.11 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,068,207 shares |

| Shares Outstanding: 114.75 (millions) |

| Market Capitalization: $1,160.17 (millions) |

| Beta: 1.01 |

| 52 Week High: $20.16 |

| 52 Week Low: $9.46 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-24.66% |

-23.68% |

| 12 Week |

-32.78% |

-32.99% |

| Year To Date |

-30.56% |

-30.04% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Matt Goldberg - Chief Executive Officer; President and Director

Gregory B. Maffei - Chairman

Michael Noonan - Chief Financial Officer

Geoffrey Gouvalaris - Chief Accounting Officer

Trynka Shineman Blake - Director

|

|

Peer Information

TripAdvisor, Inc. (COOL.)

TripAdvisor, Inc. (GFME)

TripAdvisor, Inc. (GSVI)

TripAdvisor, Inc. (GDENZ)

TripAdvisor, Inc. (EMUS)

TripAdvisor, Inc. (BFLY.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET COMMERCE

Sector: Retail/Wholesale

CUSIP: 896945201

SIC: 7370

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 114.75

Most Recent Split Date: (:1)

Beta: 1.01

Market Capitalization: $1,160.17 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.22 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.70 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 9.02% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |