| Zacks Company Profile for Toray Industries Inc. (TRYIY : OTC) |

|

|

| |

| • Company Description |

| Toray Industries, Inc. specializes in manufacturing, processing and sales of the following products: The Fibers and Textiles segment manufactures, processes and sells textile; staple fibers, spun yarns, woven and knitted fabrics of nylon and apparel products. The Plastics and Chemical segment offers plastic, nylon, polyester, polypropylene and chemical products. IT-related products segment offers films; electronic circuit- and semiconductor-related materials; color filters for LCDs; and graphic materials. The Carbon Fiber Composite Material segment manufactures and sells carbon fibers and carbon fiber composite materials. The Environment and Engineering segment offers Comprehensive engineering; condominiums; industrial equipment and machinery; environment-related equipment; water treatment membranes and related equipment; materials for housing, building and civil engineering applications. The Life Science segment manufactures and sells medical, pharmaceutical and optical products.

Number of Employees: 47,914 |

|

|

| |

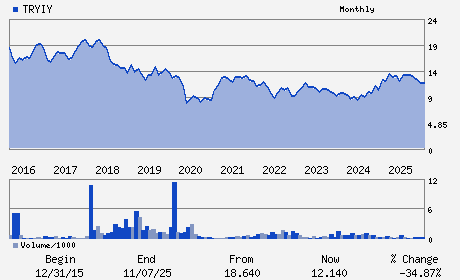

| • Price / Volume Information |

| Yesterday's Closing Price: $17.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 28,783 shares |

| Shares Outstanding: 752.24 (millions) |

| Market Capitalization: $12,825.70 (millions) |

| Beta: 0.40 |

| 52 Week High: $17.51 |

| 52 Week Low: $11.70 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

16.30% |

17.32% |

| 12 Week |

35.75% |

35.58% |

| Year To Date |

31.46% |

30.82% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Nihonbashi Mitsui Tower 1-1 Nihonbashi-Muromachi 2-chome Chuo-ku

-

Toyko,M0 103-8666

JPN |

ph: 813-3245-5113

fax: 813-3245-5459 |

ir@nts.toray.co.jp |

http://www.toray.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Mitsuo Ohya - President and Executive Officer

Akihiro Nikkaku - Chairman

Kenichiro Miki - Senior Vice President

Tetsuya Tsunekawa - Director

Shigeki Terada - Director

|

|

Peer Information

Toray Industries Inc. (CSBHY)

Toray Industries Inc. (ARWM)

Toray Industries Inc. (FUL)

Toray Industries Inc. (IAX)

Toray Industries Inc. (AVD)

Toray Industries Inc. (ASH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-SPECIALTY

Sector: Basic Materials

CUSIP: 890880206

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/13/26

|

|

Share - Related Items

Shares Outstanding: 752.24

Most Recent Split Date: 11.00 (5.00:1)

Beta: 0.40

Market Capitalization: $12,825.70 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.90% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.15 |

| Current Fiscal Year EPS Consensus Estimate: $0.71 |

Payout Ratio: 0.39 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/13/26 |

|

|

|

| |