| Zacks Company Profile for Tenaris S.A. (TS : NYSE) |

|

|

| |

| • Company Description |

| Tenaris Sa, a corporation organized in Luxembourg, is a leading manufacturer and supplier of seamless steel pipe products and associated services to the oil and gas, energy and other industries. Tenaris's operating subsidiaries include eight established steel pipe manufacturers: AlgomaTubes, Confab, Dalmine, NKKTubes, Siat, Siderca, Tamsa and Tavsa.

Number of Employees: 25,874 |

|

|

| |

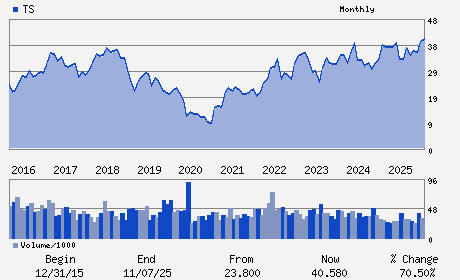

| • Price / Volume Information |

| Yesterday's Closing Price: $54.40 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,506,966 shares |

| Shares Outstanding: 581.38 (millions) |

| Market Capitalization: $31,627.00 (millions) |

| Beta: 0.87 |

| 52 Week High: $54.86 |

| 52 Week Low: $30.06 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

22.80% |

23.87% |

| 12 Week |

33.07% |

32.91% |

| Year To Date |

41.48% |

40.80% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Paolo Rocca - Chief Executive Officer and Chairman

Gabriel Podskubka - Chief Operating Officer

Alicia Mondolo - Chief Financial Officer

Simon Ayat - Director

Roberto Bonatti - Director

|

|

Peer Information

Tenaris S.A. (NSS)

Tenaris S.A. (AIU)

Tenaris S.A. (DBMG)

Tenaris S.A. (PPIH)

Tenaris S.A. (TAM.)

Tenaris S.A. (VMI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: STEEL-PIPE&TUBE

Sector: Industrial Products

CUSIP: 88031M109

SIC: 3312

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 581.38

Most Recent Split Date: 4.00 (5.00:1)

Beta: 0.87

Market Capitalization: $31,627.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.13% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.87 |

Indicated Annual Dividend: $1.16 |

| Current Fiscal Year EPS Consensus Estimate: $3.45 |

Payout Ratio: 0.32 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: 8.15% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |