| Zacks Company Profile for Grupo Televisa S.A. (TV : NYSE) |

|

|

| |

| • Company Description |

| Grupo Televisa, S.A, is the largest media company in the Spanish-speaking world, and a major player in the international entertainment business. They have interests in Television production, broadcasting, international distribution of television programming, direct-to-home satellite services, publishing, music recording, radio production and broadcasting, cable television, professional sports and show business promotions, paging services, feature film production and distribution and dubbing.

Number of Employees: 28,038 |

|

|

| |

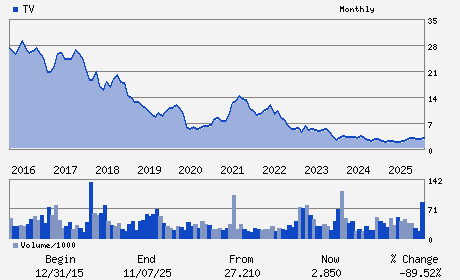

| • Price / Volume Information |

| Yesterday's Closing Price: $2.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,433,354 shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: 1.96 |

| 52 Week High: $3.49 |

| 52 Week Low: $1.55 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.79% |

-9.00% |

| 12 Week |

10.07% |

9.94% |

| Year To Date |

1.37% |

0.88% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Av. Vasco de Quiroga No. 2000 Colonia Santa Fe

-

Mexico City,O5 01210

MEX |

ph: 011-52-55-5022-5899

fax: 011-52-55-5261-2546 |

ir@televisa.com |

http://www.televisa.com |

|

|

| |

| • General Corporate Information |

Officers

Salvi Rafael Folch Viadero - Chief Executive Officer

Eduardo Tricio Haro - Chairman

Sebastian Mejia - President

Bernardo Gomez Martinez - Co-Chief Executive Officer

Enrique Francisco Jose Senior Hernandez - Managing Director

|

|

Peer Information

Grupo Televisa S.A. (PSO)

Grupo Televisa S.A. (LSXMK)

Grupo Televisa S.A. (ACCS)

Grupo Televisa S.A. (TKVR)

Grupo Televisa S.A. (TST)

Grupo Televisa S.A. (PARAA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MEDIA CONGLOM

Sector: Consumer Discretionary

CUSIP: 40049J206

SIC: 4833

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: 3.00 (4.00:1)

Beta: 1.96

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.74% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.03 |

Indicated Annual Dividend: $0.08 |

| Current Fiscal Year EPS Consensus Estimate: $0.04 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 33.93% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |