| Zacks Company Profile for Twin Disc, Incorporated (TWIN : NSDQ) |

|

|

| |

| • Company Description |

| TWIN DISC, INC. designs, manufactures and sells heavy duty off-highway power transmission equipment. Products offered include: hydraulic torqueconverters; power-shift transmissions; marine transmissions and surfacedrives; universal joints; gas turbine starting drives; power take-offs andreduction gears; industrial clutches; fluid couplings and control systems.Principal markets are: construction equipment, industrial equipment,government, marine, energy and natural resources and agriculture.

Number of Employees: 980 |

|

|

| |

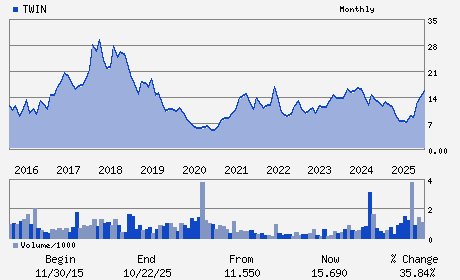

| • Price / Volume Information |

| Yesterday's Closing Price: $18.19 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 62,311 shares |

| Shares Outstanding: 14.42 (millions) |

| Market Capitalization: $262.33 (millions) |

| Beta: 0.67 |

| 52 Week High: $19.63 |

| 52 Week Low: $6.16 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.82% |

6.74% |

| 12 Week |

15.35% |

15.20% |

| Year To Date |

9.05% |

8.52% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John H. Batten - President and Chief Executive Officer

Michael C. Smiley - Chairman

Jeffrey S. Knutson - Vice President - Finance; Chief Financial Officer;

Michael Doar - Director

Janet P. Giesselman - Director

|

|

Peer Information

Twin Disc, Incorporated (B.)

Twin Disc, Incorporated (DXPE)

Twin Disc, Incorporated (AIT)

Twin Disc, Incorporated (GDI.)

Twin Disc, Incorporated (CTITQ)

Twin Disc, Incorporated (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 901476101

SIC: 3560

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 14.42

Most Recent Split Date: 1.00 (2.00:1)

Beta: 0.67

Market Capitalization: $262.33 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.88% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.36 |

Indicated Annual Dividend: $0.16 |

| Current Fiscal Year EPS Consensus Estimate: $1.07 |

Payout Ratio: 8.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 7.19 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/18/2026 - $0.04 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |