| Zacks Company Profile for United Natural Foods, Inc. (UNFI : NYSE) |

|

|

| |

| • Company Description |

| United Natural Foods, Inc. is the leading distributor of lakhs of natural, organic and specialty food and non-food products in the U.S. and Canada. Its products comprise national, regional and private label brands in six product categories like grocery & general merchandise, produce, perishables & frozen foods, nutritional supplements & sports nutrition, bulk & foodservice products as well as personal care items. It has 2 operating units: the wholesale and the manufacturing & branded products. Based on customer groups, the company reports results under the following channels. Supernatural chains consist of chain accounts that are national in scope and include natural products. It solely comprises Whole Foods Market, Inc., Chains channel, Independent Retailers channel, Retail channel including the Cub Foods business and major part of the remaining Shoppers locations, Other e-commerce and international customers channel outside of Canada. It acquired SUPERVALU.

Number of Employees: 25,600 |

|

|

| |

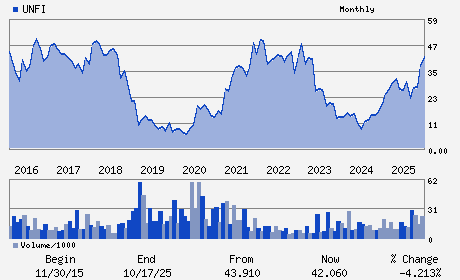

| • Price / Volume Information |

| Yesterday's Closing Price: $38.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 608,130 shares |

| Shares Outstanding: 60.93 (millions) |

| Market Capitalization: $2,328.21 (millions) |

| Beta: 1.00 |

| 52 Week High: $43.29 |

| 52 Week Low: $20.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.63% |

3.53% |

| 12 Week |

12.02% |

11.88% |

| Year To Date |

13.48% |

12.93% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

J. Alexander Miller Douglas - Chief Executive Officer and Director

Jack L. Stahl - Chairman

Giorgio Matteo Tarditi - President and Chief Financial Officer

R. Eric Esper - Chief Accounting Officer

Lynn S. Blake - Director

|

|

Peer Information

United Natural Foods, Inc. (CDSCY)

United Natural Foods, Inc. (HDNHY)

United Natural Foods, Inc. (CPB)

United Natural Foods, Inc. (AMNF)

United Natural Foods, Inc. (GMFIY)

United Natural Foods, Inc. (BRID)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: FOOD-MISC/DIVERSIFIED

Sector: Consumer Staples

CUSIP: 911163103

SIC: 5141

|

|

Fiscal Year

Fiscal Year End: July

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 60.93

Most Recent Split Date: 4.00 (2.00:1)

Beta: 1.00

Market Capitalization: $2,328.21 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.66 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.11 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |