| Zacks Company Profile for Valhi, Inc. (VHI : NYSE) |

|

|

| |

| • Company Description |

| Valhi Inc. operates through majority-owned subsidiaries or less than majority-owned affiliates in the chemicals, component products, waste management and titanium metals industries. These subsidiaries and affiliates are NL Industries, Inc. , CompX International Inc., Waste Control Specialists LLC, and Titanium Metal Corporation.

Number of Employees: 2,524 |

|

|

| |

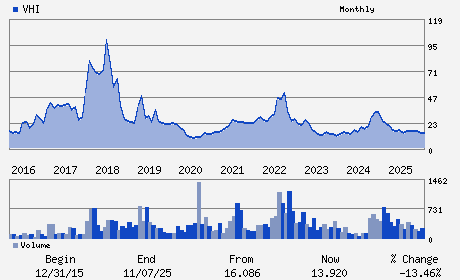

| • Price / Volume Information |

| Yesterday's Closing Price: $13.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 26,328 shares |

| Shares Outstanding: 28.30 (millions) |

| Market Capitalization: $395.38 (millions) |

| Beta: 1.19 |

| 52 Week High: $20.00 |

| 52 Week Low: $11.44 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.55% |

-0.69% |

| 12 Week |

8.97% |

8.84% |

| Year To Date |

15.93% |

15.37% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael S. Simmons - Chief Executive Officer and President

Loretta J. Feehan - Chairman

Amy Allbach Samford - Executive Vice President and Chief Financial Offic

Patty S. Brinda - Vice President and Controller

W. Hayden McIlroy - Director

|

|

Peer Information

Valhi, Inc. (ENFY)

Valhi, Inc. (EMLIF)

Valhi, Inc. (GPLB)

Valhi, Inc. (BCPUQ)

Valhi, Inc. (CYT.)

Valhi, Inc. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 918905209

SIC: 2810

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/10/26

|

|

Share - Related Items

Shares Outstanding: 28.30

Most Recent Split Date: 6.00 (0.08:1)

Beta: 1.19

Market Capitalization: $395.38 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.29% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.29 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.80 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/10/26 |

|

|

|

| |