| Zacks Company Profile for VSE Corporation (VSEC : NSDQ) |

|

|

| |

| • Company Description |

| VSE Corporation is a diversified Federal Services company of choice for solving issues of global significance with integrity, agility, and value. The company serves as a centralized management and consolidating entity for the Company's business operations. VSE is dedicated to making its clients successful by delivering talented people and innovative solutions for consulting and program management, logistics, equipment and vehicle/vessel refurbishment, engineering, information technology, energy consulting, and construction program management. VSE has three wholly-owned subsidiaries: Energetics Incorporated, Integrated Concepts and Research Corporation (ICRC), and G&B Solutions, Inc.

Number of Employees: 1,400 |

|

|

| |

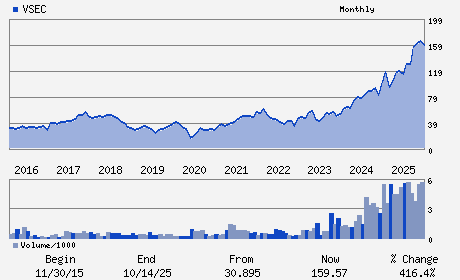

| • Price / Volume Information |

| Yesterday's Closing Price: $227.07 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 794,961 shares |

| Shares Outstanding: 23.04 (millions) |

| Market Capitalization: $5,231.54 (millions) |

| Beta: 1.34 |

| 52 Week High: $229.02 |

| 52 Week Low: $100.53 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.89% |

4.80% |

| 12 Week |

34.04% |

33.87% |

| Year To Date |

31.43% |

30.79% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John A. Cuomo - Chief Executive Officer and President

Ralph E. Eberhart - Chairman

Adam R. Cohn - Chief Financial Officer

Bonnie K. Wachtel - Director

John E. Potter - Director

|

|

Peer Information

VSE Corporation (TURN)

VSE Corporation (FWLT)

VSE Corporation (CTAK)

VSE Corporation (AVNA)

VSE Corporation (NLX.)

VSE Corporation (T.AGR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ENGINRG/R&D SVS

Sector: Construction

CUSIP: 918284100

SIC: 8711

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 23.04

Most Recent Split Date: 8.00 (2.00:1)

Beta: 1.34

Market Capitalization: $5,231.54 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.18% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.98 |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $4.39 |

Payout Ratio: 0.10 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 19.77% |

Last Dividend Paid: 01/15/2026 - $0.10 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |