| Zacks Company Profile for Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (VTMX : NYSE) |

|

|

| |

| • Company Description |

| Corporaci?n Inmobiliaria Vesta S.A.B. de C.V. is a fully-integrated, internally managed real estate company which owns, manages, develops and leases industrial properties principally in Mexico. Corporaci?n Inmobiliaria Vesta S.A.B. de C.V. is based in MEXICO CITY.

Number of Employees: 107 |

|

|

| |

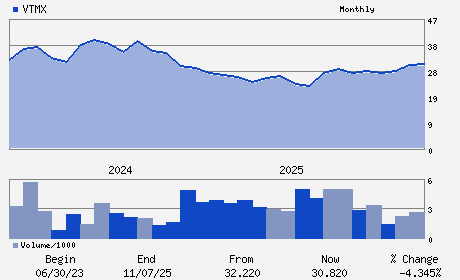

| • Price / Volume Information |

| Yesterday's Closing Price: $36.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 64,571 shares |

| Shares Outstanding: 84.60 (millions) |

| Market Capitalization: $3,107.42 (millions) |

| Beta: 0.56 |

| 52 Week High: $37.41 |

| 52 Week Low: $21.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

18.71% |

19.75% |

| 12 Week |

18.25% |

18.11% |

| Year To Date |

20.47% |

19.88% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Paseo de los Tamarindos No. 90 Torre II Piso 28 Col. Bosques de las Lomas Cuajimalpa

-

Mexico City,O5 05120

MEX |

ph: 52-55-5950-0070

fax: - |

mfbettinger@vesta.com |

https://vesta.com.mx |

|

|

| |

| • General Corporate Information |

Officers

Lorenzo Dominique Berho Carranza - Chief Executive Officer

Luis Javier Solloa Hernandez - Chairman

Juan Felipe Sottil Achutegui - Chief Financial Officer

Rodrigo Cueto Bosch - Senior Vice President; Capital Markets

Manuela Molina Peralta - Director

|

|

Peer Information

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (ARL)

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (FNDOY)

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (AOXY)

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (HLDCY)

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (IOR)

Corporacion Inmobiliaria Vesta, S.A.B. de C.V. Sponsored ADR (GYRO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REAL ESTATE OPS

Sector: Finance

CUSIP: 92540K109

SIC: 6500

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 84.60

Most Recent Split Date: (:1)

Beta: 0.56

Market Capitalization: $3,107.42 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.47% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.17 |

| Current Fiscal Year EPS Consensus Estimate: $2.00 |

Payout Ratio: 0.06 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.71 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/16/2026 - $0.17 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |