| Zacks Company Profile for VirTra, Inc. (VTSI : NSDQ) |

|

|

| |

| • Company Description |

| Virtra Systems, Inc., headquartered in Houston, Texas, develops, manufactures, markets, and sells personal computer and non-personal computer-based products for training/simulation and advertising/promotion markets. VirTra designs and manufactures two distinct product lines comprising the world's first 360-degree firearms training simulators: the IVR 4G military series, and the IVR HD law enforcement series. The HD law enforcement series delivers incredible decision making scenarios, 360-degree situational awareness, use-of-force training, real-world marksmanship, digital shoot-house, and of course marksmanship courses (from basic to advanced). The 4G military series delivers military skills training exercises, marksmanship and qualification courses (from basic to advanced), real-world marksmanship, immersive combat simulation, and digital shoot-house (CQB and MOUT training).

Number of Employees: 111 |

|

|

| |

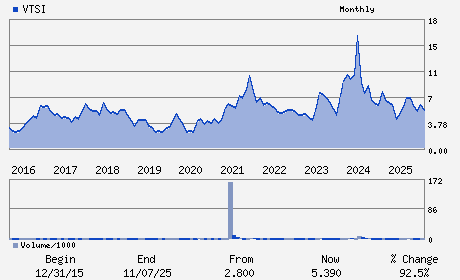

| • Price / Volume Information |

| Yesterday's Closing Price: $4.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 29,375 shares |

| Shares Outstanding: 11.30 (millions) |

| Market Capitalization: $49.27 (millions) |

| Beta: 0.66 |

| 52 Week High: $7.47 |

| 52 Week Low: $3.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.04% |

-6.22% |

| 12 Week |

-12.80% |

-12.91% |

| Year To Date |

3.81% |

3.31% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

295 E CORPORATE PLACE

-

CHANDLER,AZ 85225

USA |

ph: 480-968-1488

fax: 480-968-1448 |

vtsi@gatewayir.com |

http://www.virtra.com |

|

|

| |

| • General Corporate Information |

Officers

John F. Givens II - Chief Executive Officer

Alanna Boudreau - Chief Financial Officer

Jeffrey D. Brown - Director

Gregg C.E. Johnson - Director

Michael T. Ayers - Director

|

|

Peer Information

VirTra, Inc. (ARTX)

VirTra, Inc. (MKRS)

VirTra, Inc. (RTN.A)

VirTra, Inc. (RADA.)

VirTra, Inc. (LLL.)

VirTra, Inc. (HRLY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MILITARY

Sector: Aerospace

CUSIP: 92827K301

SIC: 3990

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 11.30

Most Recent Split Date: 3.00 (0.50:1)

Beta: 0.66

Market Capitalization: $49.27 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.01 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.17 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |