| Zacks Company Profile for Waters Corporation (WAT : NYSE) |

|

|

| |

| • Company Description |

| Waters Corp. is an analytical instrument manufacturer and offers practical and sustainable products for laboratory-dependent organizations. Moreover, Waters provides analytical workflow solutions based on mass spectrometry (MS), liquid chromatography (LC) and thermal analysis technologies. The company's products are used by pharmaceutical, life science, biochemical, industrial, academic and government customers, working in research and development, quality assurance and other laboratory applications. The company operates in Asia, Americas and Europe. Waters organizes its business into two operating segments: Waters Division and TA Division.

Number of Employees: 7,900 |

|

|

| |

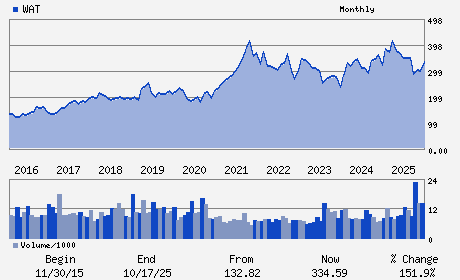

| • Price / Volume Information |

| Yesterday's Closing Price: $319.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,635,505 shares |

| Shares Outstanding: 98.10 (millions) |

| Market Capitalization: $31,331.78 (millions) |

| Beta: 1.20 |

| 52 Week High: $414.15 |

| 52 Week Low: $275.05 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.85% |

-13.10% |

| 12 Week |

-19.10% |

-19.20% |

| Year To Date |

-15.91% |

-16.32% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Udit Batra - President and Chief Executive Officer

Flemming Ornskov - Chair of the Board of Directors

Amol Chaubal - Senior Vice President and Chief Financial Officer

Linda Baddour - Director

Dan Brennan - Director

|

|

Peer Information

Waters Corporation (ABMD)

Waters Corporation (DMDS)

Waters Corporation (CPWY.)

Waters Corporation (EQUR)

Waters Corporation (ECIA)

Waters Corporation (FMS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED INSTRUMENTS

Sector: Medical

CUSIP: 941848103

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 98.10

Most Recent Split Date: 8.00 (2.00:1)

Beta: 1.20

Market Capitalization: $31,331.78 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.30 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $14.40 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.08% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |