| Zacks Company Profile for Workday, Inc. (WDAY : NSDQ) |

|

|

| |

| • Company Description |

| Workday Inc. is a provider of enterprise-level software solutions for financial management and human resource domains. The company's cloud-based platform combines finance and HR in a single system that makes it easier for organizations to provide analytical insights and decision support. Notably, organizations ranging from medium-sized businesses to enterprises have opted for Workday solutions. The company also offers open, standards-based web-services application programming interfaces and pre-built packaged integrations and connectors. The company also offers applications related to Payroll, Time Tracking, Recruiting, Learning, Planning, Professional Services Automation and Student. Workday offers Adaptive Insights Business Planning Cloud solutions, Workday Prism Analytics, Workday Data-as-a-Service and Workday Marketplace.?Workday serves technology, financial services, business services, healthcare and life sciences, manufacturing, and consumer and retail industries, education and government industries.

Number of Employees: 20,400 |

|

|

| |

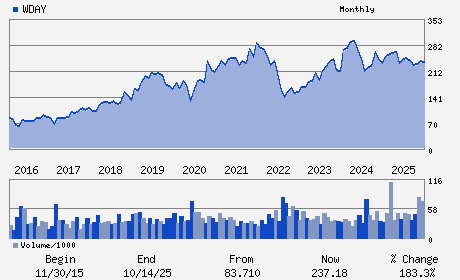

| • Price / Volume Information |

| Yesterday's Closing Price: $133.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,701,053 shares |

| Shares Outstanding: 263.00 (millions) |

| Market Capitalization: $35,178.88 (millions) |

| Beta: 1.17 |

| 52 Week High: $276.00 |

| 52 Week Low: $117.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-23.84% |

-23.17% |

| 12 Week |

-39.19% |

-39.26% |

| Year To Date |

-37.72% |

-38.03% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6110 STONERIDGE MALL ROAD

-

PLEASANTON,CA 94588

USA |

ph: 925-951-9000

fax: - |

ir@workday.com |

http://www.workday.com |

|

|

| |

| • General Corporate Information |

Officers

Carl M. Eschenbach - Chief Executive Officer and Director

Zane Rowe - Chief Financial Officer

Mark Garfield - Chief Accounting Officer

Aneel Bhusri - Director

Thomas F. Bogan - Director

|

|

Peer Information

Workday, Inc. (ADP)

Workday, Inc. (CWLD)

Workday, Inc. (CYBA.)

Workday, Inc. (ZVLO)

Workday, Inc. (AZPN)

Workday, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 98138H101

SIC: 7374

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/28/26

|

|

Share - Related Items

Shares Outstanding: 263.00

Most Recent Split Date: (:1)

Beta: 1.17

Market Capitalization: $35,178.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.17 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $5.06 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 20.16% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/28/26 |

|

|

|

| |