| Zacks Company Profile for WD-40 Company (WDFC : NSDQ) |

|

|

| |

| • Company Description |

| WD-40 Company is a tribe of passionate, committed professionals, all dedicated to the same goal: to create positive lasting memories in every interaction they have. They're a global marketing organization dedicated to creating positive lasting memories by developing and selling products that solve problems in workshops, factories and homes around the world. They offer multi-purpose maintenance products, including aerosol sprays, non-aerosol trigger sprays, and in liquid form under the WD-40 Multi-Use brand for various consumer uses; and specialty maintenance products that comprise penetrants, degreasers, corrosion inhibitors, lubricants, and rust removers under the WD-40 Specialist brand name. The company also provides products under the WD-40 Bike product brand consisting of wet and dry chain lubricants, heavy-duty degreasers, and foaming wash products for avid and recreational cyclists, bike enthusiasts, and mechanics; multi-purpose and specialty drip oils, and spray lubricant products.

Number of Employees: 714 |

|

|

| |

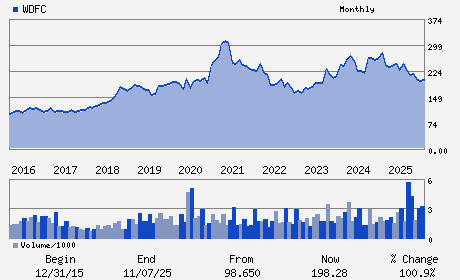

| • Price / Volume Information |

| Yesterday's Closing Price: $238.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 155,002 shares |

| Shares Outstanding: 13.49 (millions) |

| Market Capitalization: $3,212.37 (millions) |

| Beta: 0.18 |

| 52 Week High: $253.48 |

| 52 Week Low: $175.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.48% |

6.86% |

| 12 Week |

23.25% |

22.86% |

| Year To Date |

20.97% |

21.85% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Steven a. Brass - Chief Executive Officer; President and Director

Sara K. Hyzer - Vice President; Finance and Chief Financial Office

Cynthia B. Burks - Director

Trevor I. Mihalk - Director

Eric P. Etchart - Director

|

|

Peer Information

WD-40 Company (EPC)

WD-40 Company (HPPS)

WD-40 Company (ADRNY)

WD-40 Company (YHGJ)

WD-40 Company (GPSYY)

WD-40 Company (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 929236107

SIC: 2890

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/14/26

|

|

Share - Related Items

Shares Outstanding: 13.49

Most Recent Split Date: 8.00 (2.00:1)

Beta: 0.18

Market Capitalization: $3,212.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.39 |

Indicated Annual Dividend: $4.08 |

| Current Fiscal Year EPS Consensus Estimate: $6.04 |

Payout Ratio: 0.66 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/16/2026 - $1.02 |

| Next EPS Report Date: 04/14/26 |

|

|

|

| |