| Zacks Company Profile for West Japan Railway (WJRYY : OTC) |

|

|

| |

| • Company Description |

| West Japan Railway Company engages in the railway transportation business. Its operating segment consists of Transportation, Sales of Goods and Food Services, Real Estate and Other Businesses. Transportation segment provides railway, bus, and ferry services. Distribution segment operates department stores, restaurants, retail and wholesale shops. Real Estate segment sells and leases properties and manages shopping centers. Other Businesses segment includes hotels, travel agencies, advertising and construction. West Japan Railway Company is headquartered in Osaka, Japan.

Number of Employees: 45,402 |

|

|

| |

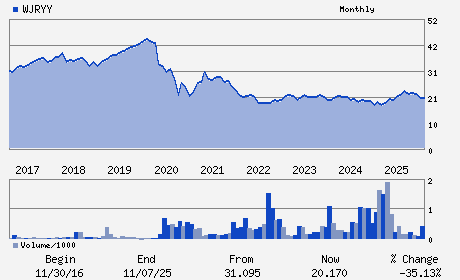

| • Price / Volume Information |

| Yesterday's Closing Price: $21.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 10,388 shares |

| Shares Outstanding: 455.56 (millions) |

| Market Capitalization: $9,767.23 (millions) |

| Beta: 0.20 |

| 52 Week High: $23.87 |

| 52 Week Low: $18.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.74% |

5.65% |

| 12 Week |

9.84% |

9.70% |

| Year To Date |

7.74% |

7.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

4-24 Shibata 2-chome Kita-ku

-

Osaka,M0 530-8341

JPN |

ph: 816-6375-8981

fax: 816-6375-8976 |

ir@westjr.co.jp |

http://www.westjr.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Kazuaki Hasegawa - President; Executive Officer & Representative Dire

Yutaka Nakanishi - Executive Officer & GM of Finance Department

Jun Fukushima - General Manager of Corporate Communications Depart

Shoji Kurasaka - Executive VP; Executive Officer & Representative D

Hiroaki Ishikawa - Chief Manager of Business Development Headquarters

|

|

Peer Information

West Japan Railway (ABCRQ)

West Japan Railway (RVSN)

West Japan Railway (CP)

West Japan Railway (FLA)

West Japan Railway (GSHHY)

West Japan Railway (BNI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-RAIL

Sector: Transportation

CUSIP: 953432101

SIC: 4731

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/01/26

|

|

Share - Related Items

Shares Outstanding: 455.56

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.20

Market Capitalization: $9,767.23 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.82% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.39 |

| Current Fiscal Year EPS Consensus Estimate: $1.73 |

Payout Ratio: 0.20 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.12 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/01/26 |

|

|

|

| |