| Zacks Company Profile for Weis Markets, Inc. (WMK : NYSE) |

|

|

| |

| • Company Description |

| Weis Markets, Inc. is engaged principally in the retail sale of food and pet supplies. It operates stores in the following states: Pennsylvania, Maryland, New Jersey, New York, Virginia and West Virginia. The SuperPetz division operates pet supply warehouse stores across the eastern U.S..

Number of Employees: 22,000 |

|

|

| |

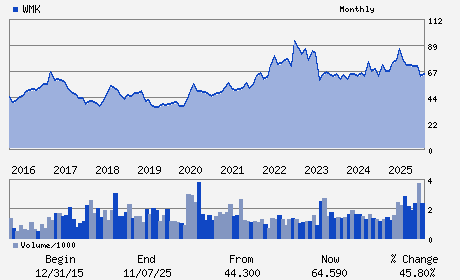

| • Price / Volume Information |

| Yesterday's Closing Price: $67.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 128,913 shares |

| Shares Outstanding: 24.75 (millions) |

| Market Capitalization: $1,676.72 (millions) |

| Beta: 0.46 |

| 52 Week High: $90.23 |

| 52 Week Low: $61.53 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.23% |

-1.96% |

| 12 Week |

1.94% |

1.62% |

| Year To Date |

5.73% |

2.64% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1000 S SECOND ST PO BOX 471

-

SUNBURY,PA 17801

USA |

ph: 570-286-4571

fax: 570-286-3286 |

None |

http://www.weismarkets.com |

|

|

| |

| • General Corporate Information |

Officers

Jonathan H. Weis - Chairman of the Board; President and Chief Executi

Robert G. Gleeson - Chief Operating Officer

David W. Gose - Senior Vice President of Operations

Michael T. Lockard - Senior Vice President; Chief Financial Officer and

James E. Marcil - Senior Vice President of Human Resources

|

|

Peer Information

Weis Markets, Inc. (DYSVY)

Weis Markets, Inc. (IFMK)

Weis Markets, Inc. (BSDNF)

Weis Markets, Inc. (GAPTQ)

Weis Markets, Inc. (DEG)

Weis Markets, Inc. (GUCO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-SUPERMKT

Sector: Retail/Wholesale

CUSIP: 948849104

SIC: 5411

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/03/26

|

|

Share - Related Items

Shares Outstanding: 24.75

Most Recent Split Date: 5.00 (1.50:1)

Beta: 0.46

Market Capitalization: $1,676.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.01% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.36 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.36 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/17/2026 - $0.34 |

| Next EPS Report Date: 03/03/26 |

|

|

|

| |