| Zacks Company Profile for W.P. Carey Inc. (WPC : NYSE) |

|

|

| |

| • Company Description |

| W. P. Carey Inc. is a real estate investment trust engaged in providing long-term sale-leaseback and build-to-suit financing for companies. The firm primarily invests in commercial properties that are generally triple-net leased to single corporate tenants including office, warehouse, industrial, logistics, retail, hotel, R&D, and self-storage properties. W. P. Carey Inc., formerly known as W. P. Carey & Co. LLC, is based in New York.

Number of Employees: 199 |

|

|

| |

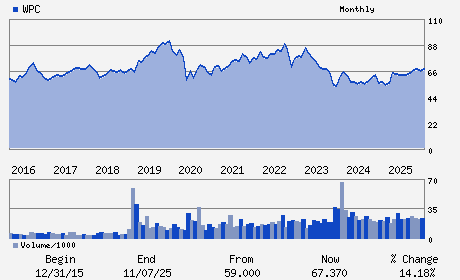

| • Price / Volume Information |

| Yesterday's Closing Price: $74.65 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,514,527 shares |

| Shares Outstanding: 219.17 (millions) |

| Market Capitalization: $16,361.04 (millions) |

| Beta: 0.78 |

| 52 Week High: $75.69 |

| 52 Week Low: $54.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.92% |

9.34% |

| 12 Week |

11.73% |

11.38% |

| Year To Date |

15.99% |

14.31% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

ONE MANHATTAN WEST 395 9TH AVENUE 58TH FLOOR

-

NEW YORK,NY 10001

USA |

ph: 212-492-1100

fax: 212-492-8922 |

ir@wpcarey.com |

http://www.wpcarey.com |

|

|

| |

| • General Corporate Information |

Officers

Jason E. Fox - Chief Executive Officer and Director

Christopher J. Niehaus - Chairman and Director

ToniAnn Sanzone - Chief Financial Officer

Brian Zander - Chief Accounting Officer

Constantin H. Beier - Director

|

|

Peer Information

W.P. Carey Inc. (ARE)

W.P. Carey Inc. (CUZ)

W.P. Carey Inc. (FUR)

W.P. Carey Inc. (NNN)

W.P. Carey Inc. (FCH)

W.P. Carey Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 92936U109

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 219.17

Most Recent Split Date: (:1)

Beta: 0.78

Market Capitalization: $16,361.04 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.93% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.22 |

Indicated Annual Dividend: $3.68 |

| Current Fiscal Year EPS Consensus Estimate: $4.95 |

Payout Ratio: 0.74 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 2.97% |

Last Dividend Paid: 12/31/2025 - $0.92 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |