| Zacks Company Profile for Wrap Technologies, Inc. (WRAP : NSDQ) |

|

|

| |

| • Company Description |

| Wrap Reality, the Company's virtual reality training system, is a fully immersive training simulator and comprehensive public safety training platform providing first responders with the discipline and practice in methods of de-escalation, conflict resolution, and use-of-force to better perform in the field. WRAP's headquarters are in Tempe, Arizona.

Number of Employees: 19 |

|

|

| |

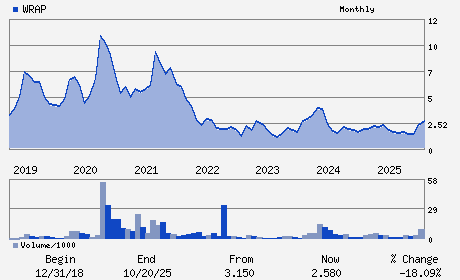

| • Price / Volume Information |

| Yesterday's Closing Price: $1.72 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 365,632 shares |

| Shares Outstanding: 54.50 (millions) |

| Market Capitalization: $93.74 (millions) |

| Beta: 1.46 |

| 52 Week High: $3.23 |

| 52 Week Low: $1.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-24.56% |

-23.57% |

| 12 Week |

-36.76% |

-36.97% |

| Year To Date |

-27.73% |

-30.48% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3480 Main Hwy Suite 202

-

Miami,FL 33133

USA |

ph: 800-583-2652

fax: - |

ir@wrap.com |

http://www.wrap.com |

|

|

| |

| • General Corporate Information |

Officers

Scot Cohen - Chief Executive Officer

Bruce Bernstein - Director

Marc Savas - Director

Rajiv Srinivasan - Director

Timothy Szymanski - Director

|

|

Peer Information

Wrap Technologies, Inc. (BRC)

Wrap Technologies, Inc. (ALGI)

Wrap Technologies, Inc. (SYNX.)

Wrap Technologies, Inc. (ADSV)

Wrap Technologies, Inc. (CDCY)

Wrap Technologies, Inc. (CSCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: PROTECTION-SFTY

Sector: Industrial Products

CUSIP: 98212N107

SIC: 3480

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/30/26

|

|

Share - Related Items

Shares Outstanding: 54.50

Most Recent Split Date: (:1)

Beta: 1.46

Market Capitalization: $93.74 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/30/26 |

|

|

|

| |