| Zacks Company Profile for Williams-Sonoma, Inc. (WSM : NYSE) |

|

|

| |

| • Company Description |

| Williams-Sonoma, Inc. is a multi-channel specialty retailer of premium quality home products. The company has five brands and each of the brands are operating segments. Pottery Barn brand offers premium quality furniture, lighting, tabletop, outdoor and decorative accessories. West Elm produces personalized products designed by the company's team of artists and designers. Williams-Sonoma offers cookware, tools, cutlery, electrics, tabletop and bar, outdoor, furniture and cookbooks. Pottery Barn Kids and Teen deals with products used for putting up nurseries, bedrooms, play spaces, furniture, bedding, lighting and decorative accents for teen bedrooms, dorm rooms, study spaces and lounges. Other segment primarily consists of international franchise operations, Rejuvenation and Mark and Graham. Rejuvenation offers premium quality products which are inspired from history. Mark and Graham is known for personalized gift items. The brand manufactures women's and men's accessories, home d?cor and seasonal items.

Number of Employees: 19,600 |

|

|

| |

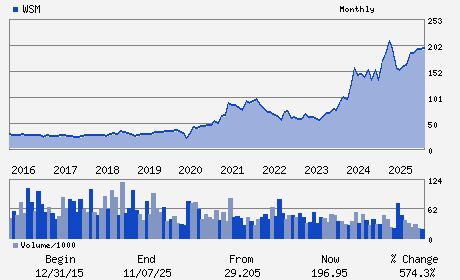

| • Price / Volume Information |

| Yesterday's Closing Price: $205.65 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 943,310 shares |

| Shares Outstanding: 119.38 (millions) |

| Market Capitalization: $24,550.64 (millions) |

| Beta: 1.64 |

| 52 Week High: $222.00 |

| 52 Week Low: $130.07 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.49% |

1.37% |

| 12 Week |

14.66% |

14.52% |

| Year To Date |

15.15% |

14.59% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Laura Alber - Chief Executive Officer

Scott Dahnke - Chairman of the Board of Directors

Jeffrey E. Howie - Chief Financial Officer

Jeremy Brooks - Chief Accounting Officer

Esi Eggleston Bracey - Director

|

|

Peer Information

Williams-Sonoma, Inc. (ETD)

Williams-Sonoma, Inc. (SUPX)

Williams-Sonoma, Inc. (LECH)

Williams-Sonoma, Inc. (LIN.)

Williams-Sonoma, Inc. (RBDSQ)

Williams-Sonoma, Inc. (BBAO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-HOME FRN

Sector: Retail/Wholesale

CUSIP: 969904101

SIC: 5700

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/18/26

|

|

Share - Related Items

Shares Outstanding: 119.38

Most Recent Split Date: 7.00 (2.00:1)

Beta: 1.64

Market Capitalization: $24,550.64 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.28% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.85 |

Indicated Annual Dividend: $2.64 |

| Current Fiscal Year EPS Consensus Estimate: $9.10 |

Payout Ratio: 0.29 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: 7.34% |

Last Dividend Paid: 01/16/2026 - $0.66 |

| Next EPS Report Date: 03/18/26 |

|

|

|

| |