| Zacks Company Profile for Xcel Energy Inc. (XEL : NSDQ) |

|

|

| |

| • Company Description |

| Xcel Energy Inc. is a holding company with subsidiaries engaged primarily in the utility business. Through its four regulated utility subsidiaries Northern States Power Company - Minnesota, NSP-Wisconsin, Public Service Company of Colorado and Southwestern Public Service Co. the company serves electricity customers and natural gas customers. Along with WYCO Development LLC and West Gas Inter State Inc., these companies comprise the regulated utility operations. Xcel Energy's operating utilities are engaged in the generation, purchase, transmission, distribution and sale of electricity in the U.S. The utilities generate electricity using coal, nuclear, hydro, wind and solar energy. Except SPS, the company's remaining utilities also purchase, transport, distribute and sell natural gas to retail customers, as well as transport customer-owned natural gas. Xcel Energy is undertaking initiatives to produce and deliver clean energy to customers.

Number of Employees: 11,534 |

|

|

| |

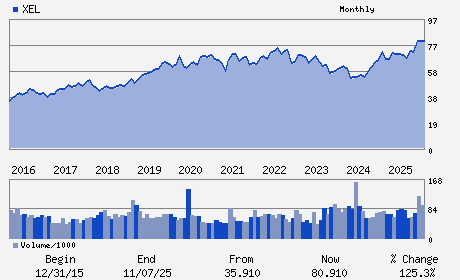

| • Price / Volume Information |

| Yesterday's Closing Price: $83.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,065,454 shares |

| Shares Outstanding: 623.88 (millions) |

| Market Capitalization: $52,006.37 (millions) |

| Beta: 0.45 |

| 52 Week High: $84.23 |

| 52 Week Low: $65.21 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.60% |

10.56% |

| 12 Week |

8.01% |

7.87% |

| Year To Date |

12.86% |

12.31% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert C. Frenzel - Chief Executive Officer; Chairman; President and D

Brian J. Van Abel - Executive Vice President; Chief Financial Officer

Melissa L. Ostrom - Senior Vice President; Controller

Megan Burkhart - Director

Lynn Casey - Director

|

|

Peer Information

Xcel Energy Inc. (ELP)

Xcel Energy Inc. (CIV)

Xcel Energy Inc. (ELPVY)

Xcel Energy Inc. (HGKGY)

Xcel Energy Inc. (AYE)

Xcel Energy Inc. (GMP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: UTIL-ELEC PWR

Sector: Utilities

CUSIP: 98389B100

SIC: 4931

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 623.88

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.45

Market Capitalization: $52,006.37 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.74% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.92 |

Indicated Annual Dividend: $2.28 |

| Current Fiscal Year EPS Consensus Estimate: $4.11 |

Payout Ratio: 0.60 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: -0.03 |

| Estmated Long-Term EPS Growth Rate: 8.88% |

Last Dividend Paid: 12/29/2025 - $0.57 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |